The post Shareholder Agreements and their impact on value appeared first on Virtus Group.

]]>Careful consideration when preparing (or revising) the shareholder agreement can better reflect the shareholders’ intentions as well as provide useful instruction and guidance to the valuator to avoid misinterpretation.

How will price/value be determined?

There are a few valuation mechanisms commonly seen in shareholder agreements to determine the value of the subject shares. While they each have their limitations, three widely used valuation mechanisms for determining the value of shares are the fixed price method, a shotgun clause, and a predetermined valuation formula.

Fixed price method

A fixed price method is where price is agreed on or negotiated in advance by the shareholders and is intended to be updated regularly, usually on an annual basis. This method is simple, easy to understand and inexpensive to adopt.

Unfortunately, this method is usually impractical due to the difficulty in getting the shareholders to agree and update the share price each year. It must be updated frequently to be useful, otherwise it will not reflect the actual value of the shares at the time of a shareholder exit.

Shotgun clause

A shotgun clause is where one shareholder of the corporation offers to purchase the shares from another shareholder, and the shareholder receiving the offer must either accept the offer or alternatively acquire the shares from the offering shareholder at the same terms and price as those offered.

This can result in inequities where one shareholder has access to significantly greater financial resources or is more actively involved with the business and thus has better insight into the operations and future prospects.

Valuation formulas

A third mechanism is the use of predetermined valuation formulas based on a multiple of historical reported earnings, sales or book value. The difficulty with this approach is that business values are influenced by both internal and external factors and a formula cannot reflect all the variables necessary to be considered for an accurate result.

Formulas are backwards facing, are based on historical figures, and a static multiple may not be reflective of future profits and growth, competitive pressures and the overall economic conditions facing the company at the transaction date. For example, one may not want to be stuck buying out a partner’s interest in a travel agency or cruise line during the COVID-19 pandemic in May 2020 based on the 2019 year end results and a multiple agreed on in 1998.

A more accurate alternative to choosing between imperfect options discussed above is to require that a valuation report be completed by a Chartered Business Valuator that can resolve the above challenges and provide an impartial assessment of value that takes into account all the relevant factors. The shareholder agreement can further stipulate the agreed-on firm who will complete the valuation where a triggering event occurs.

Which definition of value to use?

Fair Value vs. Fair Market Value

The terms “Fair Value” and “Fair Market Value” almost appear to be interchangeable, but can have significantly different value implications.

The value standard most frequently applied in notional market valuations is Fair Market Value (FMV), defined by the CBV Institute as follows:

“The highest price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.”

“Fair Value”, while not specifically defined in any of the corporation acts, has generally been interpreted by the Canadian Courts to mean fair market value without the application of a discount that would otherwise be applied to a minority shareholding.

Fair Value is more commonly used in the context of family law or in shareholder dispute cases involving minority shareholder oppression remedies.

Dealing with Life Insurance proceeds

In the event of a death of a shareholder, life insurance proceeds are commonly used to fund an acquisition of the deceased’s interest. The question arises – Should these proceeds also be considered part of the company’s value?

The amounts are often very significant and if excluded, can result in a considerable benefit to a surviving shareholder. The shareholder agreement should clarify the shareholders’ intent with respect to how these proceeds are to be accounted for when determining business value.

Another consideration is whether the proper amount of insurance is put in place. Too much insurance relative to the business value means over-spending on premiums. More commonly seen insurance coverage issues arise as the business has continued to increase in value and the current coverage may no longer be sufficient to finance an acquisition of the deceased’s interest.

Impact of a Departing Shareholder

Not everyone contributes equally to the business. And in many cases, one shareholder’s involvement is largely tied to the business’ success. So what happens when “Rainmaker Roger” retires – do I have to buy out his shares based on the level of profits generated by the business while he’s still here? Or should the business valuator instead consider the negative impact of Roger’s departure to the business when determining the fair market value of his shares?

As you can imagine, this is much easier to agree on in advance when forming the agreement, instead of at the timing of the departure.

Minority Discounts

A partial ownership interest may be worth less than its proportional ownership in the entire business. This is due to the fact that a minority shareholder does not have the same rights and privileges as a majority shareholder.

A minority shareholder is disadvantaged in that they may have little to no influence on the direction of the company, nor on the return on their investment (i.e. dividends, wages) and may be restricted in their ability to sell their shares as they wish. Due to these restrictions a theoretical investor is generally only willing to purchase these minority shares at a discount from pro-rata value, often referred to as a “minority discount”.

Depending on the circumstances, a minority discount may range anywhere from 10% – 50% (or more). Determining the appropriate discount to apply is based on a large number of factors and can be a fairly subjective exercise.

The terms of the shareholder agreement should be explicit as to whether this discount should be considered, and in what circumstances.

Conclusion

In conclusion, contemplating many of the above issues when drafting a USA can assist in better reflecting the intentions of the shareholders and also help avoid unintended financial outcomes. Certain simplified or mechanical approaches in setting value such as a formula may initially be appealing but as business and economic circumstances change over time, they can quickly become irrelevant and not reflective of the current market realities.

The value implications of the provisions within a shareholder agreement can be significant, and a Chartered Business Valuator can be useful in providing assistance with these issues.

Further Reading:

Questions? Get in touch.

Fill in the form below to get in touch with our team of Chartered Business Valuators.

The post Shareholder Agreements and their impact on value appeared first on Virtus Group.

]]>The post Business Valuations: Common Misconceptions appeared first on Virtus Group.

]]>Whether it’s simplistic reliance on valuation “rules of thumb,” outdated valuation reports, or ill-considered estimates of partial ownership interests, these misconceptions can significantly alter the understanding of what a business is genuinely worth.

This article addresses business valuation methodologies and misconceptions. We aim to provide insightful examples and deliver a comprehensive overview of the realities underpinning business valuations.

Some of those most common misconceptions include:

1. Relying on Valuation “Rules of Thumb”

“I heard that companies in my industry sell for 3 times earnings, so why do I need a business valuation?”

It’s not uncommon for a business owner to have heard through the grapevine about industry competitors selling for a certain multiple of earnings or revenue. If Joe down the street sold for 3 times earnings, then shouldn’t my business be worth the same? Such rules of thumb are simple and easy to apply, but are they reliable?

It can be tempting to believe that all companies in the same industry can be valued by the same metric. But not all businesses are the same. Two businesses within an industry can have vastly different cost structures, customer bases, management teams and a multitude of other quantitative and qualitative factors that impact what an investor might be willing to pay.

The accounting policies and tax planning used may also impact the reported financial results, making direct comparisons difficult. There may also be significant redundant assets, such as excess working capital, which does not get reflected in the simple multiplication of earnings.

Average industry multiples

An average industry multiple is also just that – an average.

As an example, according to Pratt’s Stats – Acquired Private Company Transaction Comparables, a common database for transaction data, multiples for long-haul trucking companies averaged 8.6x EBITDA (a measure of profit before interest, taxes and depreciation).

However, the actual range of EBITDA multiples paid for these businesses ranged from 1x to 119x, with the majority of transactions differing significantly from this 8.6x average. Where a company actually lies among that wide range can only be determined by a more thorough valuation approach. A “one size fits all” valuation metric can lead to an unreliable value conclusion.

Rules of thumb can be useful to get a very high-level understanding of value ranges that companies in a certain industry may transact. However, where an accurate valuation is needed there is no substitute for a formal valuation prepared by a credentialed professional.

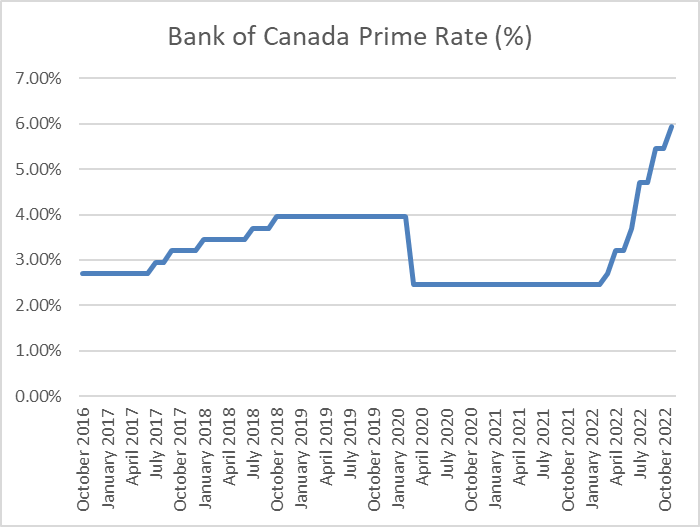

Multiples paid for privately-held businesses can also be impacted and change over time as a result of the existing monetary environment. Since this article was initially published (and especially so within the past 9 months), the borrowing costs incurred by potential purchasers to finance prospective acquisitions has changed significantly. The Bank of Canada Prime Rate has varied from a near-record low of 2.45% from March 2020 -February 2022, up to a recent 15-year high of 5.95% in November 2022.

While a rate of 5.95% is not overly significant in historical terms (Just ask a non-Millennial who was paying down a mortgage in the 80s), an over-doubling of an interest rate does impact the financial calculus to a potential purchaser who is evaluating the return on a leveraged investment, and high borrowing costs eat into that return.

All things being equal, significantly higher interest rates would generally place downward pressure on multiples being paid, with higher multiple industries and higher leveraged transactions typically being more affected. Conversely, an extended period of near-record-low rates creates the opposite investor sentiment. When borrowing costs are nearly free the appetite for investment is seemingly unlimited and multiples generally tend to increase.

2. Prior Valuation Reports

“Does my business valuation from 3 years ago still tell me how much my business is worth today?”

Value is time-specific, so a valuation that took place three years ago was based on a number of factors that may no longer hold true today. Quite a bit can change; the business may have grown in size or added new product lines, a large new competitor may have entered the local market, and there may be significant changes in the regional or world economy.

All these factors impact the future prospects of the company and consequently what a buyer would be willing to pay. The value of your business can change significantly over a short period of time, just like the stock price of a publicly traded company on the Toronto Stock Exchange.

“Pre”-Pandemic vs. “Post”-Pandemic

Also, since this article was originally published, many businesses saw significant changes to their operations, cost structure and financial position due to the impacts of the COVID-19 pandemic.

Inflation and rising operating costs have been punitive to those businesses who are unable to pass along those increased costs and recover from their customers, at the expense of shrinking profit margins. On the other end of the spectrum, some businesses have actually been able to increase their margins by raising pricing in excess of increases in their actual operating costs.

Many business models have similarly reacted and adapted over the past few years. A retail clothing store may have expanded into online sales as a necessity due to past public health guideline restrictions and created a second permanent revenue stream with lower overhead costs. There have also been changes to customer demand and preferences on how to interact and transact, some temporary, some potentially permanent.

Aside from the actual operating earnings and profits, a business’s balance sheet may also be in a better or potentially much worse position relative to just a couple of years ago. Some operations were minimally impacted by the pandemic but still qualified for excessively large amounts of federal government wage subsidies and other pandemic support programs, inflating a corporation’s bank account or allowing it to pay down debt. Alternatively, businesses in industries that have struggled financially over the past few years may have used up their cash reserves and taken on additional debt in an effort to stay afloat.

Disruptive economic events can create winners and losers and those impacts can translate to a vastly different financial picture from a valuation perspective in even a relatively short period of time.

3. Partial Ownership Interests

“If the whole business is worth $1 million, is my 10% share worth $100,000?”

In short, likely not. A partial ownership interest may be worth less than its proportional ownership in the entire business. This is due to the fact that a minority shareholder does not have the same rights and privileges as a majority shareholder.

A minority shareholder is disadvantaged in that they may have little to no influence on the direction of the company, nor on the return on their investment (i.e. dividends, wages) and may be restricted in their ability to sell their shares as they wish. Due to these restrictions, a theoretical investor is generally only willing to purchase these minority shares at a discount from pro-rata value, often referred to as a “minority discount”.

Depending on the circumstances, a minority discount may range anywhere from 10% – 50% (or more). Determining the appropriate discount to apply is based on a large number of factors and can be a fairly subjective exercise.

Conclusion

In summary, understanding business valuations is not as simple as it may seem. There is no one-size-fits-all metric or golden rule. Valuation “rules of thumb,” while helpful for a cursory glance, can grossly misrepresent a business’s value when it doesn’t consider the unique characteristics, growth, and changes a company has undergone.

Similarly, previous valuation reports may fail to provide accurate current valuations, and partial ownership interest assumptions may be based on erroneous calculations of minority discounts. Thus, a thorough and professional valuation approach is key. This not only provides an accurate depiction of the business’s worth, but it also reveals a more nuanced understanding of the business and its position within the market landscape.

In a world where business valuations can significantly impact strategic decisions and potential transactions, it’s essential to dispel these misconceptions in order to reflect the true underlying value.

Questions? Get in touch.

Get in touch with our team of Chartered Business Valuators by filling in the form below.

The post Business Valuations: Common Misconceptions appeared first on Virtus Group.

]]>The post Preparing a business for sale – the final means to resolve a dispute? appeared first on Virtus Group.

]]>NOTE: This article was written for and first appeared in the March 2022 issue of The Advocate, produced by the Saskatchewan Trial Lawyers Association

The business sale process may not be something you assist with regularly, but sometimes a family law situation or a significant shareholder dispute may result in a business being marketed for sale. If this is the ultimate means to assist in resolving the dispute, the more work that can be done in advance will significantly enhance the ultimate proceeds available.

And the more proceeds available, the higher the likelihood that the financial implications of the dispute can be resolved. Below is a summary of a few key questions that can be asked to assist in the process to be prepared for sale.

Is there a preferred timing for a sale?

In most cases, timing is critical. It can be a factor in ensuring that the sale occurs in the strong period of the economic cycle, or provide additional certainty that the key Management is still with the business for a reasonable period if retirement is in the not-too-distant future.

It may be important if there are major multi-year contracts that have just been renewed which give the new buyer comfort in the future revenue stream. All these things assist in reducing the risk for the new owner. Lower risk typically means higher multiples of earnings (if it is an income or cash flow approach to determining the value), and higher multiples mean higher values.

Perhaps it is as simple as time is required to execute the company’s key strategies which are designed to enhance value. Whatever the case, the earlier the company can start the process of being prepared for sale, the higher the likelihood of an enhanced value.

Do the owners understand their pricing and non-pricing objectives?

The owners need to have a realistic understanding of what the value of the Company is, and even more important is understanding what the value drivers of the company are and how an external party will determine value.

- What is the scalability of the business model without adding on significant new costs?

- What are the recurring revenue streams that can be relied upon?

- What is the “stickiness” of customer relationships?

- What are the growth possibilities?

- Is there any intellectual property that exists?

- Do we have a strategic competitive advantage that enhances value?

- Do we have a strong Management Team?

- Do our financial systems provide timely, accurate financial information that allows us to really understand the operations?

- What is our market position and market share?

- Do we work in an industry where safety statistics are critical?

- What is our safety rating?

- Do we have any cost advantages relative to our competitors?

- Do economies of scale exist?

How Chartered Business Valuators can help

Work with a Chartered Business Valuator to get an understanding of value, and what can be done to enhance value prior to the sale process.

Non-pricing objectives are critical as well. In a number of cases, the non-financial elements of a transaction can be just as sensitive as the pricing objectives.

- Will the existing Management Team remain in place, or will the new owners put in their own management?

- Will the new owners change the name of the company?

- Move the operations to a different city?

- Get into product lines that are more controversial from a public perception perspective?

- Do the owners have significant Environmental, Social & Governance (ESG) principles that they want maintained?

The earlier that the exiting owners can think about and understand how they would react to such potential changes helps to limit the risk of the deal falling apart at the end.

Have the owners considered the different types of potential proceeds?

If the business is an operating entity, and particularly if it is of significant value, it is rare for the purchaser to simply pay cash and have everyone go their separate ways. Purchasers are looking to limit their risk, and one means to do this is to have the exiting owners retain some of this risk for a period of time. This might mean that part of the proceeds is not immediately received by the exiting owners.

The purchasers may request that the owners finance part of the sale by taking both cash and debt (i.e. a “Vendor Take Back”), with the debt paid over time from the earnings of the Company. Alternatively, they may request that the “debt” is not fully quantified on sale, and is based on the future earnings of the Company (i.e. an “Earn Out”).

Or they may want the owners to remain as a minority shareholder, and share the future risk associated with the Company. The exiting owners need to consider each of these alternatives and be prepared to either accept or reject these structures.

Are there assets or divisions that would be excluded from the sale?

The owners need to consider what assets may or may not be included in the sale process. Perhaps there is an entire division that could be carved out of the sale process and the owner / owners will continue to operate that division.

- If the Company owns the land and building that are utilized for operations, are they included in the sale or would they be stripped out?

- Are there certain assets in the business (we have seen everything from pieces of art to airplanes) that are not to be included in the sale?

- Life insurance can be difficult to obtain as we age….are the existing life insurance policies held within the business to be stripped out? All of these decisions, when made early in the process, assist in avoiding issues that could derail the deal later.

All of these decisions, when made early in the process, assist in avoiding issues that could derail the deal later.

Are the potential buyers known?

Understanding who the likely buyers are assists in the marketing process. Is it likely that a “Strategic Buyer” (perhaps a competitor) is the preferred option?

They would have knowledge of the industry, the Company, the economic environment it is operating in, and perhaps able to take advantage of synergies that will make the transaction more economically justified.

Or is it more likely to be a “Financial Buyer”, like a private equity group, that will assist in providing additional capital needed for expansion, etc.? Are the key employees a possibility? Do they have the expertise necessary to run the full business, and can they obtain financing to do the acquisition?

Are all contracts and agreements up to date?

When going through the sale process, the buyer’s due diligence process can be intense. This means that the sellers need to be organized and ready for the barrage of questions that the buyers will want answers for. This will include ensuring that the legal and governance aspects of the organization are well documented.

- Are the building lease agreements and renewals up to date?

- Do we know where all the equipment lease documents are, and what the buyouts might be?

- Is the corporate minute book current?

- Do we have copies of any manufacturing or service contracts available?

- Distribution or dealer contracts?

- Can we quickly provide copies of all contracts associated with our credit facilities?

- Are all key employees under an employment agreement?

By being able to quickly provide copies of these critical documents continues to show the potential purchasers that you are organized. And being organized helps to reduce the concept of risk. And as identified above….lower risk means higher multiples, and higher multiples mean a higher value.

Tax and Legal Considerations

When preparing a business for sale, it can also take significant time for tax and legal considerations to be implemented. In addition, some tax changes require that the new structure be in place for a reasonable period (i.e. two years in some cases), for the changes to result in the desired outcome. As a result, forethought on these strategies is required.

- Is a restructure necessary to take advantage of the Lifetime Capital Gains Exemption?

- Can we simplify the structure to avoid additional due diligent costs or ensure effective tax planning?

- Do we have any outstanding CRA audit issues?

- Have we considered all the locations where the Company does business, and are we comfortable that we have considered all the tax requirements for these different jurisdictions?

- Do we have any existing lawsuits or potential litigation that may have to be disclosed? Any product recall or product warranty issues that could come up?

Again, answers to all these questions need to be prepared to mitigate any issues late in the sale process.

What does it all mean?

The discussion above is the tip of the iceberg of the issues to be considered when a company prepares for sale. It has been mentioned a few times above, but the most important message can be summarized as follows…if we can show that we are organized, and we limit any surprises, it reduces the level of risk in the eyes of the potential purchaser. Again, reduced risk means higher multiples, and higher multiples mean a higher overall value.

We all know that litigation cases can go on for a long period of time. We should not miss the opportunity of having a discussion of a potential sale early in the process. If the time comes for a sale to take place, we will have utilized that time effectively to maximize value.

If in the end a sale does not take place, the worst-case scenario is that the Company is more organized, understands its value drivers, and the owners have a clearer picture of what their objectives might be when the time does come for a sale.

Do not be afraid to consult a Chartered Business Valuator for guidance. We are only a phone call away, and will typically be able to assess the needs quickly for you and your client.

Questions?

Contact our Business Valuation Group for advice on valuing your client’s business, determining income for support purposes, calculating economic losses, or any other financial analysis you may require. Fill in the form below to get started.

Questions? Get in touch.

The post Preparing a business for sale – the final means to resolve a dispute? appeared first on Virtus Group.

]]>The post Difference Between Business Valuations & Financial Statements appeared first on Virtus Group.

]]>The shares held in your business are likely one of the largest assets you have. You may have spent years nurturing the business, building up its products and markets, developing its management team, and demonstrating profitability. As a result, putting a value on this business should not be taken lightly.

The short answer to the above noted question is…..”probably not”. There is a significant difference between a valuation report prepared to value the shares of a business and the financial statements of that business. The reason there is a difference is relatively simple; financial statements are not intended to place value on a business, but rather capture the historical transactions that the company has engaged in. A valuation report does what its name implies; it values the business based on future potential and opportunity.

In order to understand the difference, a brief explanation of each helps to remove some of the mysteries.

Financial Statements

Financial statements of any particular company typically have the following:

- A balance sheet, listing the original or depreciated cost of all assets held by the business, the liabilities it owes, and the equity which was injected or retained in the business, all at a specific date.

- A statement of operations, showing the revenues and expenses of the company for the last fiscal period, which is typically one year.

- A statement of cash flows, showing how the cash flows generated in the operations were utilized, and their impact on the balance sheet.

Valuation Report

A valuation report represents a Chartered Business Valuator’s professional judgement as to the value of the business. This value will be based on either the fair market value of the assets, less the liabilities, or a capitalized value of the cash flows the company is anticipated to generate in the future. It takes into account the future earnings potential of the business, and assesses the risks associated with generating those earnings.

The Pitfalls of Using Financial Statements

The primary issue we are dealing with when utilizing financial statements is that they are dealing with historical amounts. The balance sheet will list amounts at “book value”, which may or may not bear any resemblance to the actual fair market value of the assets or liabilities. At times, some advisors may assume that the “Shareholders Equity” or “Retained Earnings” amount is a reasonable representation of the fair market value of the business, as it represents the difference between the book value of the assets owned and the liabilities owed. However, there are a number of items which must be considered:

- Are the current assets, including accounts receivable and inventory properly valued? Are there items that are not reported (crop in the field, yearling calves, gravel pits, parts inventories, etc.)?

- Is the original cost of the land and the depreciated cost of the building and equipment really representative of the fair market value?

- Are there any environmental issues associated with any of the assets? Reclamation costs required?

- Does the company have “investments” and does this cost have any correlation with fair market value?

- Are there any subsidiaries, the values of which are not properly reflected in the initial nominal share issuance?

- What about the inherent tax impacts of any of the above-noted adjustments? Are these taken into account on the historical balance sheet?

- Are all liabilities properly recorded?

- Is there any unrecorded deferred compensation which may become payable?

- Are there share option agreements or convertible debentures that would have a significant impact on the number of shares outstanding, and hence share value?

The answers to these questions can dramatically change the amount which would be considered the fair market value of the company’s shares. And that’s before we even discuss the major game changer, namely:

- Are there intangible assets carried on the balance sheet? If so, does this amount represent the actual fair market value of customer lists, intellectual property, general goodwill, etc.?

Intangible Value and Goodwill – Does it Exist?

Intangible value, commonly referred to as Goodwill, is one of the most misunderstood concepts in valuation theory. Put simply, the value of goodwill can be summarized as follows:

What am I willing to pay to get control over a business which generates cash, taking into account the risks associated with generating that cash…

…less…

The fair market value of the net assets necessary to generate those cash flows.

Financial statements will not identify this amount; they will simply identify the value of intangible assets or goodwill which has been purchased in past transactions. In most businesses, goodwill is developed over time and is as a result of years of profitable operations, or the development of products or services which create a barrier to entry into the marketplace. If it has never been purchased, it will never show up on the financial statements. As a result, analysis of the financial information is necessary to determine if intangible value or goodwill exists, and if so, how much.

When preparing a valuation report, this is one of the key areas of focus. Determination of the sustainable earnings of the company is made by considering both the historical and projected operating results, taking into account “normalization adjustments” which are intended to adjust the earnings for items which are not considered recurring. These potential earnings are then “capitalized” by applying a rate of return or multiple, determining the total value of the enterprise. This total value is then compared to the fair market value of the assets employed to determine if any intangible value or goodwill exists. A significant amount of work and expertise may be required to normalize the earnings, determine the risk factors, understand the products and services offered, and take into account industry and market conditions to determine total value.

What does it all mean?

In the end, be very careful about using the financial statements to assist in determining value. At times, the financial statements may actually be quite close to the fair market value however, this typically relies upon more luck than skill. There are a number of factors which must be taken into account and only by considering all the factors are you to determine a value that can be utilized in a fair and equitable solution.

Don’t be afraid to consult a Chartered Business Valuator for guidance. We are only a phone call away, and will typically be able to assess your needs quickly.

Questions? Get in touch with one of our experts.

The post Difference Between Business Valuations & Financial Statements appeared first on Virtus Group.

]]>The post Understanding Minority Discounts appeared first on Virtus Group.

]]>A minority discounts reflects the premise that a partial ownership interest may be worth less than its proportional ownership in the entire business. A non-controlling shareholder does not have the same privileges and rights as a majority shareholder and a minority discount applies a reduction in value due to this lack of control.

Valuators use the concept of “Fair Market Value”, where value is based on the highest price that prudent investors are willing to pay in an open and unrestricted market. A minority shareholder is disadvantaged in that they may have little to no influence on the direction of the company, on the return of their investment (whether in the form of dividends or wages), and may be restricted in their ability to sell their shares as they wish. These restrictions often make a minority block of shares a much less attractive value proposition to an investor, who consequently becomes less willing to pay top dollar.

When and where minority discounts arise

There are a variety of situations that arise where a business and its shareholders must evaluate the worth of not only the overall business but also the individual ownership interests. Divorce, death, retirement and buyouts between disputing shareholders are some common examples where the value of individual shareholder interests must be determined, but these interests are not always valued on a pro-rata basis relative to total corporate value.

A minority discount is typically applied in situations where the shareholder does not have de jure or de facto control, but there are exceptions. In cases involving dissent, appraisal and oppression remedies, the courts have generally held that minority share interests be valued without the consideration of a discount.

A shareholder with de jure control typically controls (either directly or indirectly) in excess of 50% of the voting shares of a company and generally has the ability to elect a majority of the board of directors. This shareholder may also control many aspects of the company’s operations (with some restrictions), including making daily operating decisions and determining the timing and quantum of dividends to be paid.

Furthermore, in several Canadian incorporation jurisdictions (including Saskatchewan) and unless otherwise precluded by the provisions of a shareholder agreement, a shareholder with a full two-thirds or 66.6% of the votes can independently pass a special resolution to enact fundamental changes to the business, including changing the entire strategic direction of the company, disposing of most of the underlying assets or winding up the operations.

In essence, the individual with more than 50% of the shares is the controlling shareholder, with de jure control, and can make many decisions without the consent of other partners–even if there is only one other shareholder with 49% of the shares. In this situation if the business is valued at $1,000,000 and the shareholder with de jure control holds 51% of shares then his or her shares are generally valued at their pro-rated value, or $510,000. Where it becomes more complex is determining a value for the remaining shareholder interest that comprise 49% of the shares because these shares, if sold independently, are likely not worth $490,000.

The remaining 49% of shares would generally be subject to a discount from their pro-rated or proportional ownership value, and this discount can be significant. Depending on the circumstances, a minority discount may range anywhere between 10% – 50% (or more), which, based on our million dollar business example would translate into a value between $441,000 and $245,000.

Determination of a discount

A minority discount may still apply even where no single shareholder has control. In the case of a company whose shares are evenly distributed between two shareholders, each with 50%, neither has voting majority over the other. Each shareholder would certainly have influence in governing the affairs of the company, but not the ability to unilaterally make key decisions.

The determination of a discount to apply in the valuation of a minority interest can be a fairly subjective exercise, given it is based on an interpretation of the facts that are specific to the circumstance. Even amongst Chartered Business Valuators there can be a difference of opinion in a given scenario, although most generally fall within a limited range.

In determining the discount, a large number of factors are considered, including but not limited to:

- The provisions in the shareholder agreement

- The shareholder’s level of involvement in the business

- The nature of the business and whether a market for the shares exists

- Whether the minority interest has nuisance value

- The size of the shareholding in comparison to the other shareholdings

- Shareholder relationships and the existence of family or group control

Where a shareholder agreement is in place, it may state whether and in what situations a discount is to apply, and (less commonly) may provide an explicit percentage discount. The shareholders may wish to have a departing shareholder’s interest valued differently depending on the circumstances. For example, they may wish to have no discount in the case of death or permanent disability of a shareholder, but opt for a punitive discount to apply where a shareholder departs voluntarily. Other provisions may stipulate how control is determined in the company or set restrictions on the transfer of shares thereby affecting the shareholder’s ability to sell their ownership as they choose.

Other practical considerations

Given that the provisions of a shareholder agreement can have such a significant impact, it is crucial that it be reviewed and perhaps even revised on a regular basis to reflect the current intentions of the shareholders. This sets the expectations for the parties involved as to how their interests are to be treated upon disposal and goes a long way to help avoid future disputes.

In summary, whether or not a minority discount is to apply in a given situation centers on whether the shareholder has control, and to the extent that the shareholder is restricted, both in the ability to govern the company and their ability to realize a return on their investment. As the value implications can be significant, a Chartered Business Valuator can be useful in providing assistance on these issues.

If you would like more information about minority discounts or have questions and comments about this article, please contact Frank Hounjet, CPA, CA, CBV at Virtus Group Chartered Professional Accountants & Business Advisors 306-653-6100 or fill out the form below.

Questions? Get in touch.

The post Understanding Minority Discounts appeared first on Virtus Group.

]]>