Navigating the world of business valuations can be a daunting task for many business owners. This complex domain is rife with common misconceptions and misunderstandings that may obscure the true value of a business.

Whether it’s simplistic reliance on valuation “rules of thumb,” outdated valuation reports, or ill-considered estimates of partial ownership interests, these misconceptions can significantly alter the understanding of what a business is genuinely worth.

This article addresses business valuation methodologies and misconceptions. We aim to provide insightful examples and deliver a comprehensive overview of the realities underpinning business valuations.

Some of those most common misconceptions include:

1. Relying on Valuation “Rules of Thumb”

“I heard that companies in my industry sell for 3 times earnings, so why do I need a business valuation?”

It’s not uncommon for a business owner to have heard through the grapevine about industry competitors selling for a certain multiple of earnings or revenue. If Joe down the street sold for 3 times earnings, then shouldn’t my business be worth the same? Such rules of thumb are simple and easy to apply, but are they reliable?

It can be tempting to believe that all companies in the same industry can be valued by the same metric. But not all businesses are the same. Two businesses within an industry can have vastly different cost structures, customer bases, management teams and a multitude of other quantitative and qualitative factors that impact what an investor might be willing to pay.

The accounting policies and tax planning used may also impact the reported financial results, making direct comparisons difficult. There may also be significant redundant assets, such as excess working capital, which does not get reflected in the simple multiplication of earnings.

Average industry multiples

An average industry multiple is also just that – an average.

As an example, according to Pratt’s Stats – Acquired Private Company Transaction Comparables, a common database for transaction data, multiples for long-haul trucking companies averaged 8.6x EBITDA (a measure of profit before interest, taxes and depreciation).

However, the actual range of EBITDA multiples paid for these businesses ranged from 1x to 119x, with the majority of transactions differing significantly from this 8.6x average. Where a company actually lies among that wide range can only be determined by a more thorough valuation approach. A “one size fits all” valuation metric can lead to an unreliable value conclusion.

Rules of thumb can be useful to get a very high-level understanding of value ranges that companies in a certain industry may transact. However, where an accurate valuation is needed there is no substitute for a formal valuation prepared by a credentialed professional.

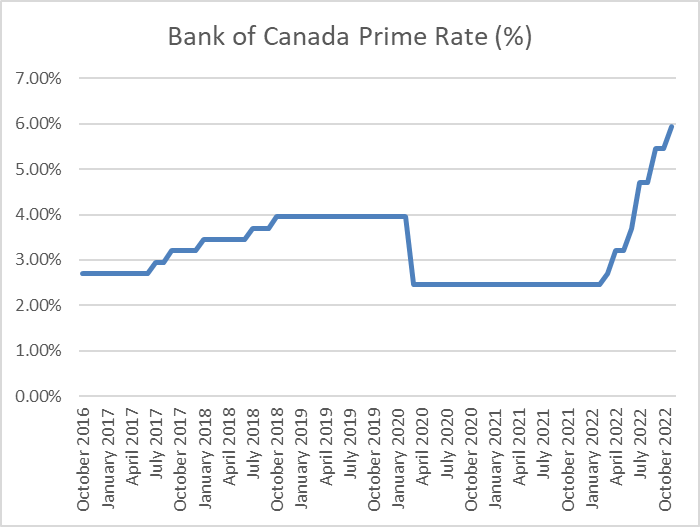

Multiples paid for privately-held businesses can also be impacted and change over time as a result of the existing monetary environment. Since this article was initially published (and especially so within the past 9 months), the borrowing costs incurred by potential purchasers to finance prospective acquisitions has changed significantly. The Bank of Canada Prime Rate has varied from a near-record low of 2.45% from March 2020 -February 2022, up to a recent 15-year high of 5.95% in November 2022.

While a rate of 5.95% is not overly significant in historical terms (Just ask a non-Millennial who was paying down a mortgage in the 80s), an over-doubling of an interest rate does impact the financial calculus to a potential purchaser who is evaluating the return on a leveraged investment, and high borrowing costs eat into that return.

All things being equal, significantly higher interest rates would generally place downward pressure on multiples being paid, with higher multiple industries and higher leveraged transactions typically being more affected. Conversely, an extended period of near-record-low rates creates the opposite investor sentiment. When borrowing costs are nearly free the appetite for investment is seemingly unlimited and multiples generally tend to increase.

2. Prior Valuation Reports

“Does my business valuation from 3 years ago still tell me how much my business is worth today?”

Value is time-specific, so a valuation that took place three years ago was based on a number of factors that may no longer hold true today. Quite a bit can change; the business may have grown in size or added new product lines, a large new competitor may have entered the local market, and there may be significant changes in the regional or world economy.

All these factors impact the future prospects of the company and consequently what a buyer would be willing to pay. The value of your business can change significantly over a short period of time, just like the stock price of a publicly traded company on the Toronto Stock Exchange.

“Pre”-Pandemic vs. “Post”-Pandemic

Also, since this article was originally published, many businesses saw significant changes to their operations, cost structure and financial position due to the impacts of the COVID-19 pandemic.

Inflation and rising operating costs have been punitive to those businesses who are unable to pass along those increased costs and recover from their customers, at the expense of shrinking profit margins. On the other end of the spectrum, some businesses have actually been able to increase their margins by raising pricing in excess of increases in their actual operating costs.

Many business models have similarly reacted and adapted over the past few years. A retail clothing store may have expanded into online sales as a necessity due to past public health guideline restrictions and created a second permanent revenue stream with lower overhead costs. There have also been changes to customer demand and preferences on how to interact and transact, some temporary, some potentially permanent.

Aside from the actual operating earnings and profits, a business’s balance sheet may also be in a better or potentially much worse position relative to just a couple of years ago. Some operations were minimally impacted by the pandemic but still qualified for excessively large amounts of federal government wage subsidies and other pandemic support programs, inflating a corporation’s bank account or allowing it to pay down debt. Alternatively, businesses in industries that have struggled financially over the past few years may have used up their cash reserves and taken on additional debt in an effort to stay afloat.

Disruptive economic events can create winners and losers and those impacts can translate to a vastly different financial picture from a valuation perspective in even a relatively short period of time.

3. Partial Ownership Interests

“If the whole business is worth $1 million, is my 10% share worth $100,000?”

In short, likely not. A partial ownership interest may be worth less than its proportional ownership in the entire business. This is due to the fact that a minority shareholder does not have the same rights and privileges as a majority shareholder.

A minority shareholder is disadvantaged in that they may have little to no influence on the direction of the company, nor on the return on their investment (i.e. dividends, wages) and may be restricted in their ability to sell their shares as they wish. Due to these restrictions, a theoretical investor is generally only willing to purchase these minority shares at a discount from pro-rata value, often referred to as a “minority discount”.

Depending on the circumstances, a minority discount may range anywhere from 10% – 50% (or more). Determining the appropriate discount to apply is based on a large number of factors and can be a fairly subjective exercise.

Conclusion

In summary, understanding business valuations is not as simple as it may seem. There is no one-size-fits-all metric or golden rule. Valuation “rules of thumb,” while helpful for a cursory glance, can grossly misrepresent a business’s value when it doesn’t consider the unique characteristics, growth, and changes a company has undergone.

Similarly, previous valuation reports may fail to provide accurate current valuations, and partial ownership interest assumptions may be based on erroneous calculations of minority discounts. Thus, a thorough and professional valuation approach is key. This not only provides an accurate depiction of the business’s worth, but it also reveals a more nuanced understanding of the business and its position within the market landscape.

In a world where business valuations can significantly impact strategic decisions and potential transactions, it’s essential to dispel these misconceptions in order to reflect the true underlying value.

Questions? Get in touch.

Get in touch with our team of Chartered Business Valuators by filling in the form below.