The post Expansion of Business Investment Tax Support Announced appeared first on Virtus Group.

]]>On February 4, 2022, the Department of Finance released draft legislation intended to enact numerous measures previously announced in the 2021 Federal Budget. This draft legislation is open to public comment at this stage and is not yet enacted.

The rules allowing immediate deductibility of eligible capital asset additions are of particular note. Those rules will apply to purchases made after the effective date of April 19, 2021 which are available for use before Jan 1, 2024.

Canadian-controlled private businesses will be able to deduct in the year of purchase the full cost of selected assets that would normally be deducted over multiple years.

The $1.5M limit is for each tax year and must be shared between “associated” corporations, and will apply to most capital assets (excluding buildings and some intangibles and assets acquired from non-arm’s length parties).

Additionally, they announced that individuals and qualified partnerships would also qualify for the immediate deduction for similar assets available for use between January 1, 2022 and December 31, 2024; the same $1.5M limit is in place, and is subject to similar sharing rules.

Once the legislation has been enacted, the new rules can be used to increase deductions for qualifying taxpayers. For tax returns already filed that may be able to qualify for additional tax savings, amendments to those returns would be possible as well.

Further reading:

Read the Department of Finance’s full statement here.

Questions?

Get in touch with our tax team by filling in the form below.

Get in touch.

The post Expansion of Business Investment Tax Support Announced appeared first on Virtus Group.

]]>The post 4 Professional Services Trends in 2022 & Beyond appeared first on Virtus Group.

]]>Where is technology trending for professional services?

It’s no secret that the global COVID-19 pandemic we’ve experienced over the past 18 months has radically transformed entire industries. Even “traditional” industries like accounting, finance and legal services in typically “traditional” markets like Saskatchewan, and Canada in general, have been deeply impacted by the new reality we’ve faced. Research suggests that there is more change coming.

1. Digital Transformation of Traditional Industries

All it took was a global pandemic to force many “traditional” firms in “traditional” industries, such as legal and accounting, into the 21st century technologically. If prior to March of 2020, your firm didn’t have a set work-from-home policy as an example, you certainly weren’t alone.

A firm’s “tech stack” was not something most partners had concerned themselves with. However, fast forward 18 months and the firms that were forced to shift to remote operations at the beginning of the pandemic have completely digitized both their workforce and their client experience. From Zoom webinars to CRMs, ERPs and data flow to hiring remote workers, forward-thinking firms have rethought the processes of old and have positioned themselves to be able to take advantage of new opportunities in 2022 and the future.

2. Fintech & Automation

Financial technology or “fintech”, has become an integral part of a firm’s digital transformation. Long gone are the days when bookkeeping and financials are done with pen and paper. From our firm’s perspective, fintech like Quickbooks Online (QBO) has revolutionized how our business operates. We can now tie together QBO with our cloud-based accounts payable, payment processing and reporting software functionalities. Having financial data in the cloud allows for opportunities like industry-specific integrations that provide real-time information and more accurate forecasting.

On the automation side, Robotic Process Automation (RPA) will continue to be adopted by firms in a bid to improve efficiencies, especially for repetitive and mundane administrative tasks. RPA refers to software that can be easily programmed to do basic, repetitive tasks across applications. RPA creates and deploys a software “bot” with the ability to launch and operate other software.

According to a recent report by McKinsey, a large international bank was able to automate over 900 of its back-end operations via RPA. This relieved 50% of its full-time employees from their administrative tasks and allowed the bank to redeploy resources to increase efficiencies within their organization.

Some of these employees were successfully deployed in other meaningful activities within the bank to increase overall productivity. We’d expect the application of RPA amongst professional services firms to give a similar boost to efficiency and productivity. Given the anticipated turnover tsunami and the corresponding recruiting and retention challenges that are looming, increasing efficiencies through RPA may be the coming sooner rather than later.

3. Cyber Security & Compliance

As professional services firms turn towards technology to fill in gaps and improve processes, the issue of cybersecurity and compliance will continue to be at the forefront. Businesses that understand their data processes well and can reflect this transparency to consumers and regulatory authorities will find themselves suitably ahead of a change that many are only starting to take notice of.

Adding to the cyber security risk has been an increase in demand for remote working access, contact-less document delivery and payment processing, as well as cybercriminals casting larger nets in their quest to find and exploit vulnerabilities. Small- to mid-sized professional service firms may have been fortunate enough to fly under the radar in the past, but these days every business needs to be protected. If your firm isn’t regularly testing for gaps in your cybersecurity, you could be vulnerable and unaware of it.

4. Recruiting, Retention, and the Rise of the Gig Economy

According to Randstad Canada, approximately 30% of the Canadian workforce is made up of non-traditional workers. The same report estimates that by 2025 32% of workers will be employed remotely or virtually while another 25% will work multiple “gigs” as part-time consultants.

The pandemic has expedited this shift towards freelancers, consultants and independent contractors. Business leaders are transforming their organizations by building an agile workforce in a bid to reduce overhead and increase operational efficiencies.

The response to the pandemic and the surge forward in technological fluency has already shifted some or all of the workforce of many businesses to working remotely. The younger staff in professional firms are continuing to seek out more control over work schedules and many are pushing back on traditional billable hour expectations with a desire to define their own work-life balance.

With the majority of professional service firm leadership nearing the age of retirement, succession planning and a focus on recruiting and retaining top talent are critical to ensure the successful transition of leadership and firm continuity. As firms look to fill the void left by the retiring baby boomer generation, high levels of compensation will no longer be enough to be an employer of choice. Top candidates are looking to get comfort on the complete package including firm culture, mentorship programs, and other perks and benefits.

We’ve all dealt with more change in the last 18 months than we may have liked, but all indications are that there is even more to come. Navigating your firm through these challenges starts with the willingness of leadership to change and rethink traditional ways of doing business.

Get in touch

Questions about the article, strategic planning or advisory services? Fill in the form to get in touch with Marc!

The post 4 Professional Services Trends in 2022 & Beyond appeared first on Virtus Group.

]]>The post Wage & Rent Subsidies Remain Unchanged appeared first on Virtus Group.

]]>Businesses, non-profits, and charities that have experienced a decline in revenues while weathering the COVID-19 crisis are eligible for a variety of government support measures including direct subsidies to support workers and pay rent.

- The Canada Emergency Wage Subsidy helps employers retain and quickly rehire workers previously laid off.

- The Canada Emergency Rent Subsidy provides direct and easy-to-access rent and mortgage interest support to tenants and property owners.

- Lockdown Support provides additional rent relief to organizations that are subject to a lockdown and must shut their doors or significantly restrict their activities under a public health order issued under the laws of Canada, or a province or a territory.

The wage subsidy, the rent subsidy, and Lockdown Support are legislated to be available until June 2021. Proposed program details, from March 14 to June 5, 2021, for the three measures are described below.

Maintaining the Current Rate Structures Until June 5, 2021

The rate structures for the wage subsidy for active employees, the rent subsidy, and Lockdown Support that are currently in place until March 13, 2021, would be extended for March 14 to June 5, 2021. This means that:

- The maximum base wage subsidy rate for active employees would remain at 40 per cent, and the maximum top-up wage subsidy rate for employers most adversely impacted by the pandemic would remain at 35 per cent. As such, the maximum combined wage subsidy rate would remain at 75 per cent.

- The maximum rent subsidy rate would remain at 65 per cent.

- Lockdown Support would remain at 25 per cent and continue to be provided in addition to the rent subsidy, providing eligible hard hit businesses with rent support of up to 90 per cent.

Support for Furloughed Employees

A separate wage subsidy rate structure applies for furloughed employees. To ensure that the wage subsidy for furloughed employees remains aligned with benefits available under Employment Insurance (EI), and that workers are provided with equitable treatment between the two programs, the weekly wage subsidy for a furloughed employee, from March 14 to June 5, 2021, would remain the same and continue to be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

Employers would also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan for furloughed employees.

Revenue-decline Reference Periods Until June 2021

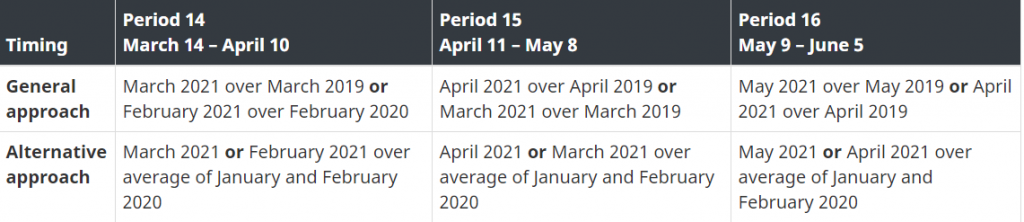

Since the wage subsidy and rent subsidy programs launched, an organization’s decline in revenues has generally been determined by comparing the change in the organization’s revenues in a current calendar month with its revenues in the same calendar month of the previous year. An organization may also elect to use an alternative approach, which compares the change in the organization’s monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an organization’s decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Given that we are approaching a full year of the COVID-19 pandemic, to ensure that the general approach continues to calculate an organization’s decline in revenues relative to a pre-pandemic month, the prior reference periods would be based on calendar months from 2019, effective as of the qualifying period from March 14 to April 10, 2021. The proposed reference periods are summarized in Table 1.

TABLE 1: CANADA EMERGENCY WAGE SUBSIDY AND CANADA EMERGENCY RENT SUBSIDY REFERENCE PERIODS

PERIODS 14 TO 16 (MARCH 14 TO JUNE 5, 2021)

Employers that had chosen to use the general approach for prior periods would continue to use that approach. Similarly, employers that had chosen to use the alternative approach would continue to use the alternative approach.

More Flexible Baseline Remuneration Periods

An eligible employer’s entitlement to the wage subsidy for a furloughed employee or an active non-arm’s length employee is determined through a calculation that takes into account both the employee’s current and baseline (pre-crisis) remuneration.

By default, baseline remuneration means the average weekly eligible remuneration paid to an eligible employee by an eligible employer during the period beginning January 1, 2020, and ending March 15, 2020. Any period of seven or more consecutive days for which the employee was not remunerated is excluded from the calculation. However, the eligible employer may elect an alternative baseline period for calculating the average weekly eligible remuneration.

An additional elective alternative baseline remuneration computation for March 14 to June 5, 2021 (Qualifying Periods 14 to 16), is proposed to ensure that the baseline remuneration comparator remains appropriate. In particular, an eligible employer would be allowed to elect, for qualifying periods from March 14 to June 5, 2021, to use the period of March 1, 2019 to June 30, 2019, or July 1 to December 31, 2019 (the current alternative period), to calculate baseline remuneration.

The Canada Revenue Agency will administer this measure on the basis of draft legislative proposals released with today’s announcement.

The estimated cost for the wage subsidy from March 14 to June 5, 2021, is $13.9 billion in 2021-22 and the estimated cost for the rent subsidy and Lockdown Support from March 14 to June 5, 2021 is $2.1 billion in 2021-22. Costs may change depending on changing public health restrictions and economic activity.

Questions? Get in touch.

The post Wage & Rent Subsidies Remain Unchanged appeared first on Virtus Group.

]]>The post New COVID Support Program Available for Renters and Property Owners appeared first on Virtus Group.

]]>The CRA has released information and the application process through this link.

https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-rent-subsidy.html

Eligibility for the CERS program is open to individuals, taxable corporations and trusts, registered charities, certain non-taxable entities, as well as certain partnerships and specifically allowed organizations – however public institutions are specifically excluded. The applicant must also either have a CRA Business Number at Sept 27, 2020 or a CRA payroll account at March 15, 2020 (or someone making payroll remittances on their behalf). As well, it could be possible to establish a Business Number now to apply, or to make an election if a business assets have been acquired from a person that would have been eligible.

At this point, the CERS program rules have been released for 3 periods – Sept 27 to Oct 24 (claim process available now), Oct 25 to Nov 21 and Nov 22 to Dec 19 – but the program has been approved until June 21, 2021 so it is anticipated that further periods will be authorized. The deadline for applications is 180 days after the end of the particular period – meaning first period applications can be made until April 2021.

Qualifying property includes land and buildings in Canada used by the applicant in “ordinary activities”, but does not include property used as a personal residence. A wide variety of commercial and industrial buildings, retail space, storage compounds and even farm land could create a claim.

Calculating the potential CERS benefit is based on revenue reduction percentage of the applicant, and these criteria are modeled on the rules previously announced, and periodically updated, for the Canada Emergency Wage Subsidy. There are many fine details to the revenue calculations, but generally the month’s 2020 revenue for that respective application period would be compared to the revenue in the same month for 2019, or the average of the Jan/Feb 2020 revenue, and the decrease expressed as a percentage . Revenue from non-arm’s length sources – generally entities with common owners – is ignored for these calculations. As with the CEWS, it will be possible to use the more beneficial of the current period revenue decrease, or the immediately preceding period revenue decrease, in determining the amount of the CERS, and to choose between the cash or accrual method for recording revenue. There are also a variety of elections for applicants in regards to consolidated groups of entities, entities that participate in joint ventures arrangements, affiliated groups or applicants that received almost all of their revenue from non-arm’s length parties.

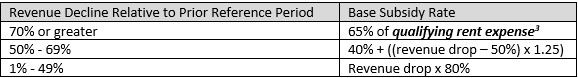

Once an eligible entity has determined their property qualifies and the amount of their revenue decline percentage, the calculation of the CERS base rate is as follows:

The rent top-up calculation is quite a bit easier – in each application period up to 25% can be added to the CERS base rate (if it was more than 0%) for the pro-rated period that the entity was subject to a “public health restriction”. Such a restriction is defined as a COVID related order from the government or authorized body that carries a fine or sanction that restricts some activities of the applicant that would affect at least 25% of their revenue that lasts at least one week. For example, a 14-day Saskatchewan government order to close the lounge that provides 40% of an entity’s revenue would create a rent top-up percentage of 12.5% – 25% * 14 days of the order / 28 days in the qualifying period.

Qualifying rent expense (“QRE”) is also more complex than the name suggests. In order to qualify as QRE, amounts must be paid in respect the 4-week application period (which CRA has indicated could be done up to 60 days after receipt of the CERS payment) in relation to a written agreement from before Oct 9, 2020 to arm’s length parties. What costs are eligible depends on the structure of the agreement, who owns the property and to whom the payments are being made.

Renters paying amounts to arm’s length parties would be eligible to claim base rent, contingent rent, certain amounts received by the landlord under the previous Canada Emergency Commercial Rent Assistance program, as well as additional amounts required to be paid under a net lease. These additional amounts are considered pretty broadly to include insurance, utilities, common area and other operating costs, property taxes and a general “other amounts payable” for services related to real property rental. An important criteria here is that the payments must be made to an arm’s length party – an operating business paying rent for a property owned in an entity owned by the same people (a fairly common structure) would NOT qualify under this definition, only amounts paid to third parties would be included. Specifically excluded are sales taxes, costs for damages, defaults, interest/penalties, guarantees or indemnities and special services or reconciliation adjustments.

Property owners – whether they use their property in non-rental activities in the same entity, or if they primarily rent the property to non-arm’s length parties – can also make a CERS claim but on a more limited list of costs. QRE in these situations consists of insurance and property taxes, as well as mortgage interest (not principal payments). However, the mortgage interest calculation has additional criteria to limit interest amount to the lesser of the interest calculations if they were calculated based on: the lowest principal balance on the property’s mortgage since it was acquired, or the cost amount of the property. Under these conditions, buildings that have been owned for a significant period, or that have greatly increased in value since acquisition and been used as security for borrowing, will not likely be able to claim their entire actual interest cost as QRE.

And in both cases, any rental revenue earned from arm’s length parties (including sub leases for renters) will directly reduce the applicant QRE amount.

To combat potential misuse of the CERS program, the rules also contain penalty provisions similar to the CEWS program. Attempts to manipulate the revenue calculations or qualifying rent expense amounts in order to qualify for CERS, or otherwise increase the amount of the CERS benefit applicable, will result in denial of any CERS benefit and a penalty of 25% of the amount that would have been available if the submission had been processed.

The CERS is another significant program with the potential to provide substantial benefit to qualifying applicants, but the rules are complex. Virtus Group has a team of professionals available to assist with assessing your situation and completing your applications – please contact your Virtus representative with any questions.

Questions? Get in touch with one of our experts.

The post New COVID Support Program Available for Renters and Property Owners appeared first on Virtus Group.

]]>The post Estate Planning in the wake of COVID-19 appeared first on Virtus Group.

]]>Having a valid Will and reviewing your Will

A valid Will ensures that your property goes to your intended beneficiaries when you die. A Will is also important to ensure that your estate is processed in a timely and tax efficient manner. With the down-turn in the economy, it is important to not only ensure you have a valid Will but also review your Will to verify that it still meets your intentions given the impact of COVID-19 on your estate assets and liabilities.

Having a Power of Attorney

In light of the COVID-19 pandemic, one should also give serious thought to a power of attorney. If a serious illness renders you incapable of making financial or personal-care decisions, well-planned powers of attorney ensure that a trusted person can make these decisions on your behalf. A continuing power of attorney persists if you become mentally incapable of managing your own affairs.

Using a Capital Dividend Account (CDA) to generate tax-free distributions and reduce the value of the corporation

The CDA is a notional account that tracks various tax-free amounts that a private corporation receives. The following are amounts, among others, that are added to a private corporation’s CDA balance:

- Non-taxable portion of capital gains in excess of non-deductible portion of capital losses realized by the corporation;

- Capital dividends received by the corporation; and

- Proceeds of life insurance policies that are tax exempt.

To pay a tax-free dividend from its CDA, the corporation must file a tax election to designate the amount of the dividend to be a capital dividend and must file prescribed supporting documents. Failure to file the tax election and supporting documents by the due date will result in a penalty that increases monthly.

A corporation’s CDA is valuable because it indicates the amount that an individual shareholder can receive as tax-free distributions from the corporation while reducing the value of the corporation shares for estate purposes. Timing can be crucial to maximize the benefit of the CDA. If a corporation crystalizes losses as a way of reducing taxable income – which is certainly a strategy that many businesses are considering due to COVID-19’s effect on the economy – the corporation may be unknowingly reducing (or even eliminating) the CDA balance.

Business owners who plan to incur capital losses as part of a plan to generate liquidity through the reduction of current year taxes, or recovery of prior year taxes, should consider paying out the full balance of the CDA before crystalizing those losses.

Utilizing an estate freeze or refreeze to transfer future growth to the next generation

An estate freeze refers to planning that has the effect of transferring the future growth in value of a business, investments, or other assets into the hands of subsequent generations. The current owners (typically the parents) are effectively divested of this future growth by exchanging their common shares (growth shares) for fixed value preferred shares (freeze shares) and then the next generation or a family trust then subscribes to common shares. An estate freeze then limits the value added to the parents’ Estate to the value at the date the freeze is implemented.

The main reason to implement a freeze or a refreeze is to maximize the value of the family assets that will ultimately pass to the freezor’s beneficiaries. An individual is deemed to dispose of his or her capital property on death at fair market value. So reducing the value of one’s personally held property that will be subject to these deemed disposition rules serves to reduce taxes owing from the Estate at death, and maximize the value of the family assets received by the beneficiaries from the Estate and owned directly or indirectly after the freeze.

For this reason, an estate freeze becomes more effective if implemented when the assets of the freezor are expected to appreciate. During the economic downturn created by COVID-19, the value of many businesses has dropped and so it may be a good time to implement an estate freeze or refreeze.

Conclusion

COVID-19 has created a situation where we are considering our loved-one’s health and their economic well-being. These considerations pair well with having a proper estate plan that considers your specific family situation and goes well beyond the few topics discussed in this article. For help with your specific estate plan, feel free to reach out to your Virtus Group LLP representative.

The post Estate Planning in the wake of COVID-19 appeared first on Virtus Group.

]]>The post Significant Changes to Canada Emergency Wage Subsidy appeared first on Virtus Group.

]]>For most of the claim periods to July 4, an employer must have experienced a revenue decrease of at least 30% in order to qualify, and all employers meeting the eligibility criteria receive the same level of maximum subsidy funding per employee (75% of $1,129, or $847 per week). The subsidy maximum was triggered regardless of how significant the revenue decrease was below 30%, and no subsidy was received if the threshold was not met. This rigid 30% threshold was seen as a disincentive to growth as employers may forgo opportunities for potentially increased business operations – which would normally include hiring more staff and expanded economic activity for their suppliers – if it meant they would rise above the 30% threshold and therefore lose the CEWS funding.

Providing continued support to the economy as it continues to recover, removing an employers’ disincentive to grow revenue, and focusing additional funding on industries most adversely affected by COVID are the stated goals for the proposed changes. However, the government also wants to reduce their cost of the CEWS so they are implementing a gradual reduction in the maximum subsidy claim over the next five 4-week claim periods (starting July 5 and ending November 21) with details for the November 22 – December 19 period not released yet. The maximum weekly amount of wages eligible for the subsidy has not changed from $1,129/week.

CEWS benefit based on current and historical declines in revenue with staged decline of maximum support amount

Under this proposal, the CEWS would have two components – a “base subsidy” for any employer with a decline in revenue in the claim period, and a “top-up subsidy” for employers with more significant declines in revenue over a longer time frame. The combined subsidy amount would apply to active employees, with furloughed employees subject to a separate calculation. As well, employees who are without remuneration from the employer-claimant for more than 14 days will no longer be excluded from the definition of “eligible employee” and their wages would be eligible for CEWS support.

The maximum base subsidy would be available to employers with revenue decline of at least 50% in each claim period, but the amount of the base subsidy would decrease over time – 60% in Periods 5 and 6, 50% in P7, 40% in P8 and 20% in P9. Employers with less than 50% decline in revenue would receive a subsidy percentage based on their specific decline. In P5 and P6, the maximum subsidy would be 1.2x the percentage decline, 1.0x in P7, 0.8x in P8 and 0.4x in P9. Therefore a 20% revenue decline in July would result in a 24% maximum wage subsidy – or $270 if the employee was eligible for the maximum subsidized wage amount. That same 20% revenue decline in October would result in a 16% maximum wage subsidy – or $181 of CEWS benefit.

In addition to the base subsidy, employers who experienced an average revenue decline of more than 50% in the previous 3 month period would have their maximum CEWS subsidy rate increased by up to 25% over the base subsidy amount. Employers with an average revenue decline of 70% or more would receive the full 25% addition, with average declines between 50% and 70% receiving a proportionate amount of the 25% addition to any eligible base subsidy amount.

Claimants retain ability to maximize CEWS support between prior and proposed rules

The proposal also include a “safe harbour” provision that would allow employers that would have qualified for the 75% maximum subsidy amount in P5/P6 under the original 30% revenue decline criteria will still receive that 75% subsidy amount for those two periods. Claimants that would be able to receive more than 75% through the base subsidy and top up subsidy would be able to receive the higher amount.

Going forward, the employer’s current period CEWS rate will be based on the greater of their current monthly revenue decline, and their previous month’s revenue decline, providing a more stable support amount and avoiding a sudden decrease in support when revenues increase. Employers will retain the ability to choose how they calculate their revenue decline – cash or accrual basis of accounting, current month comparison to either the prior year or their Jan/Feb 2020 average – but will have the ability to use different calculation methods in Periods 1-4 and Periods 5-9 if they wish.

The end result of the proposals would be to expand the CEWS support to more employers for a longer period of time, but also gradually reduce the amounts paid on behalf of each employee. The legislative changes will need to be passed by Parliament (introduction and First Reading were done today) and there is no definitive time frame for that process to be completed, however, Period 5 will end August 1 so it will be important for employers to receive certainty on the potential benefits available when making their business decisions.

These proposals are complex and potential claimants should be sure they understand them fully before making a CEWS claim for any relevant claim period. More details on the proposed changes and example calculations are available in the Department of Finance release.

Questions? Get in touch.

The post Significant Changes to Canada Emergency Wage Subsidy appeared first on Virtus Group.

]]>The post Revised CEBA Loan Eligibility Now Available appeared first on Virtus Group.

]]>Unfortunately, the revised eligibility criteria require a more detailed look at the other expenses incurred by the business and only certain expenses are being counted. We have attempted to distill the expanded CEBA information below, please review closely to determine if your business might now qualify for this beneficial program. Click here for the official government website https://ceba-cuec.ca/

In order for a business (the Borrower) with $20,000 or less of 2019 payroll to qualify, they will need to demonstrate having net “eligible non-deferrable expenses” (ENDE) of $40,000 to $1,500,000 in 2020. The application process begins at the Borrower’s bank, and funding occurs when the Borrower provides additional information and acceptable documentation for the ENDE to the Government. The “acceptable documentation” listed on the CEBA website are “electronic/paper copies of Receipts/Invoice/Agreements” that support the 2020 ENDE and hopefully more clarity will be released in the future.

The ENDE listed on the CEBA website, and mirrored on the bank applications we have seen, are:

- Wages and other employment expenses to independent (arm’s length) third parties – this appears to exclude any wages or salaries paid to the owner or their close relatives (parents, kids, siblings, spouses) and does not include increased management compensation;

- Rent or lease payments for real estate used for business purposes;

- Rent or lease payments for capital equipment used for business purposes;

- Payments incurred for insurance related costs;

- Payments incurred for property taxes;

- Payments incurred for business purposes for telephone and utilities in the form of gas, oil, electricity, water and internet;

- Payments for regularly scheduled debt service – we believe this means both interest and principal payments on loans previously scheduled for repayment, but cannot be sure as it is not defined. Prepayment/refinancing of debts not previously scheduled would NOT qualify;

- Payments incurred under agreements with independent contractors and fees required in order to maintain licenses, authorizations or permissions necessary to conduct business by the Borrower – the use of the word “independent” for contractors mirrors the wording for wages, so we believe this also excludes amounts paid to the owner or their close relatives.

These are the only expenses eligible at this time under the revised criteria, so businesses that do not have significant expenses in these categories will likely not be eligible for the CEBA loan. The time period for these expenses appears to be all of 2020, so if sufficient expenses can be supported now then the entire $40,000 loan funding may be received in the short term. However, additional ENDE that are incurred in the remaining months of 2020 can also be submitted to reach the $40,000 threshold of supported expenses.

In the calculation of the $40,000 to $1,500,000 thresholds, the total of the ENDE above will be reduced by the amounts of any support received, or expected to be received, under the Government of Canada COVID support programs to arrive at the “net” amount. The listing of these programs are:

- Canada Emergency Wage Subsidy,

- 10% Temporary Wage Subsidy,

- Canada Emergency Commercial Rent Assistance, Regional Relief and Recovery Fund,

- Futurpreneur Canada,

- Northern Business Relief Fund,

- Fish Harvester Grant,

- Relief measures for Indigenous businesses, and

- $250 million COVID-19 IRAP (Industrial Research Assistance Program) Subsidy Program

The total amount of the ENDE for 2020 less any amounts under these support programs must be between $40,000 and $1,500,000 to be eligible for the CEBA loan. Any Borrowed funds received must be used for payment of the ENDE of the business and for payment of other non-deferrable operating expenses (even though only the ENDE amounts are eligible to qualify for the CEBA loan).

Other eligibility criteria that must be met under that expanded CEBA criteria that have not changed from the original are:

- Borrower was a Canadian operating business at March 1, 2020 with a federal tax registration

- Borrower had an active business chequing/operating account with the bank it applies at, open prior to March 1, 2020 and not in arrears by 90 days or more on existing borrowing

- Borrower can only apply once

- Borrower acknowledges that it intends to continue, or resume, its business operations

- Borrower agrees to participate in post-funding surveys

- Certain Borrowers are excluded – government organization; entities owned by Federal MPs or Senators; non-profits, charities, unions and fraternal orders and entities owned by them, unless the entity carried on an active business in Canada; and organizations that promote hate, violence or discrimination.

Hopefully, this expanded criteria will allow more businesses to qualify for the CEBA program and help them through the COVID crisis. For businesses that still do not qualify under these expended criteria, the Regional Recovery and Relief Program may be another avenue to explore for support. We had previously emailed information on that program on May 15th, or information is available here from Western Economic Diversification (https://www.wd-deo.gc.ca/eng/20059.asp).

Questions? Get in touch with one of our experts.

The post Revised CEBA Loan Eligibility Now Available appeared first on Virtus Group.

]]>The post Expanded CECRA and CEBA applications opening May 25 appeared first on Virtus Group.

]]>More information on the CECRA program (originally announced April 24, 2020) was provided today during the Prime Minister’s daily COVID update speech. This program will provide a forgivable loan to landlords for up to 50% of a commercial tenant’s monthly rent, if the landlord and tenants agree to modify their existing lease agreement so that the tenant will pay no more than 25% of the original rent and the landlord will forgive at least 75% of the original rent for April, May and June 2020.

The mechanics of the program appear to work so that the rent reduction agreement becomes binding once final approval is given to the CECRA application. The landlord would receive the loan proceeds and any rent paid by the tenant, once the criteria of the CECRA application have been met then the loan would be forgiven and the landlord would provide refunds or credits to the tenant for any amount received in excess of the amount agreed to under the rent reduction agreement.

In order to qualify, the tenant must have experienced a 70% decline in gross revenue in April/May/June of 2020 compared to the corresponding month in 2019 (or to the average of Jan/Feb 2020 if the business was not in operation in 2019), the original monthly rent amount must have been $50,000 or less per location, and the tenant (or ultimate parent company of the tenant in certain situations) must have had less than $20 million in gross annual revenue in 2019.

As well, the landlord must agree to a moratorium on evictions and that they will not recoup the reduced rent under the agreement in other ways after the agreement is over.

Further resources:

Additional information and FAQs for both tenants and landlords

The applications for CECRA will be available starting May 25, 2020 through the Canada Mortgage and Housing Corporation, which would require forecasting information about June revenue for tenants. Information is already posted at the link above so potential applicant landlords and tenants can work towards determining eligibility and preparing the necessary information.

There is no requirement that the commercial property have a current mortgage in order to apply for the program, the program is being managed by CMHC due to its expertise and experience with real estate in Canada. The Federal Government is encouraging landlords and tenants to apply for the CECRA program if applicable, but there is no requirement to do so.

The CECRA program has significantly more paperwork and legal documentation requirements than the other COVID-19 support programs presented by the Federal Government, but they have provided sample documents to provide examples of the underlying details.

Applications can be made up to August 31, 2020. The program is open to situations where the tenant and landlord are non-arm’s length, as long as the other requirements have been met.

Expansion of Canada Emergency Benefits Account (CEBA) to businesses with less than $20,000 of payroll in 2019

In the May 19, 2020 COVID-19 update speech from the Prime Minister, it was announced that the CEBA loan program was going to be expanded again to allow more active businesses access the $40,000 interest-free, partially forgivable loan to help with operating costs during the COVID-19 crisis. The program originally was accessible to businesses with $50,000 to $1,000,000 of payroll in 2019, then was expanded to businesses with $20,000 to $1,500,000 in 2019 payroll, and this expansion will allow businesses with less than $20,000 of payroll in 2019 to qualify.

The applicant business must have an active business account with a participating financial institution, have filed a 2018 or 2019 tax return, and have between $40,000 and $1,500,000 of eligible non-deferrable expenses (including rent, property taxes, utilities or insurance, among others). The other CEBA criteria regarding eligible use of the funds and repayment timing to access the partial forgiveness are not expected to be any different.

More details will be released in the coming days, and we will provide more detailed information as it becomes available – both the Canada.ca website and the major bank websites have not been updated for these changes. This expanded CEBA criteria may cause conflicts with the Regional Relief and Recovery Fund (RRRF) program we provided information on last Friday.

In order to apply for the RRRF funding, a business had to attest that it was not eligible for CEBA, so this expanded CEBA eligibility may now make businesses ineligible for the RRRF funding that would have been eligible under the previous CEBA rules.

Further reading:

The post Expanded CECRA and CEBA applications opening May 25 appeared first on Virtus Group.

]]>The post Canada Emergency Wage Subsidy (CEWS) – Applications Now Open appeared first on Virtus Group.

]]>The rules behind the eligibility and amounts of the potential claims are complex, and have been subject to clarification and discussion since the legislation was passed on April 11th, so ensuring you have the proper information is important. At Virtus Group, we are here to provide the latest information and assist employers to ensure they can properly access the CEWS amount they are entitled to claim.

Resources on our website include a summary of the eligibility rules, details on the calculation of the subsidy amounts claimable from employee wages, and a spreadsheet to analyze your specific situation under those details. The list of CRA Q&A clarifications is updated periodically to provide guidance on situations not clearly described in the legislation, including those that are more complex or unique.

Together, this information can assist you in making your CEWS claim through the CRA online portal.

As well, Virtus Group is available to provide assistance with the CEWS program – from answering your questions to working with you to gather and summarize the required information to completing the CEWS claim on your behalf. Just contact your Virtus representative to discuss further.

The post Canada Emergency Wage Subsidy (CEWS) – Applications Now Open appeared first on Virtus Group.

]]>The post Expansion of Workers Eligible for the Canada Emergency Response Benefit appeared first on Virtus Group.

]]>Questions? Get in touch.

The post Expansion of Workers Eligible for the Canada Emergency Response Benefit appeared first on Virtus Group.

]]>