Businesses, non-profits, and charities that have experienced a decline in revenues while weathering the COVID-19 crisis are eligible for a variety of government support measures including direct subsidies to support workers and pay rent.

- The Canada Emergency Wage Subsidy helps employers retain and quickly rehire workers previously laid off.

- The Canada Emergency Rent Subsidy provides direct and easy-to-access rent and mortgage interest support to tenants and property owners.

- Lockdown Support provides additional rent relief to organizations that are subject to a lockdown and must shut their doors or significantly restrict their activities under a public health order issued under the laws of Canada, or a province or a territory.

The wage subsidy, the rent subsidy, and Lockdown Support are legislated to be available until June 2021. Proposed program details, from March 14 to June 5, 2021, for the three measures are described below.

Maintaining the Current Rate Structures Until June 5, 2021

The rate structures for the wage subsidy for active employees, the rent subsidy, and Lockdown Support that are currently in place until March 13, 2021, would be extended for March 14 to June 5, 2021. This means that:

- The maximum base wage subsidy rate for active employees would remain at 40 per cent, and the maximum top-up wage subsidy rate for employers most adversely impacted by the pandemic would remain at 35 per cent. As such, the maximum combined wage subsidy rate would remain at 75 per cent.

- The maximum rent subsidy rate would remain at 65 per cent.

- Lockdown Support would remain at 25 per cent and continue to be provided in addition to the rent subsidy, providing eligible hard hit businesses with rent support of up to 90 per cent.

Support for Furloughed Employees

A separate wage subsidy rate structure applies for furloughed employees. To ensure that the wage subsidy for furloughed employees remains aligned with benefits available under Employment Insurance (EI), and that workers are provided with equitable treatment between the two programs, the weekly wage subsidy for a furloughed employee, from March 14 to June 5, 2021, would remain the same and continue to be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

Employers would also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan for furloughed employees.

Revenue-decline Reference Periods Until June 2021

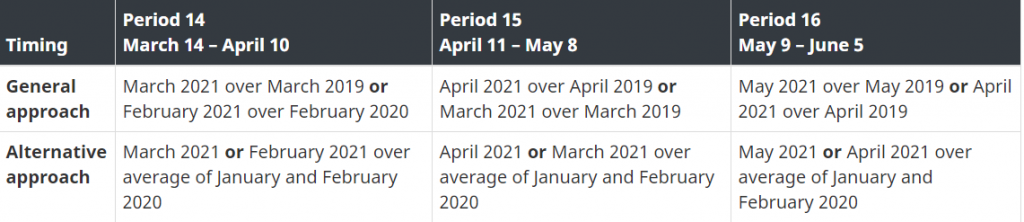

Since the wage subsidy and rent subsidy programs launched, an organization’s decline in revenues has generally been determined by comparing the change in the organization’s revenues in a current calendar month with its revenues in the same calendar month of the previous year. An organization may also elect to use an alternative approach, which compares the change in the organization’s monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an organization’s decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Given that we are approaching a full year of the COVID-19 pandemic, to ensure that the general approach continues to calculate an organization’s decline in revenues relative to a pre-pandemic month, the prior reference periods would be based on calendar months from 2019, effective as of the qualifying period from March 14 to April 10, 2021. The proposed reference periods are summarized in Table 1.

TABLE 1: CANADA EMERGENCY WAGE SUBSIDY AND CANADA EMERGENCY RENT SUBSIDY REFERENCE PERIODS

PERIODS 14 TO 16 (MARCH 14 TO JUNE 5, 2021)

Employers that had chosen to use the general approach for prior periods would continue to use that approach. Similarly, employers that had chosen to use the alternative approach would continue to use the alternative approach.

More Flexible Baseline Remuneration Periods

An eligible employer’s entitlement to the wage subsidy for a furloughed employee or an active non-arm’s length employee is determined through a calculation that takes into account both the employee’s current and baseline (pre-crisis) remuneration.

By default, baseline remuneration means the average weekly eligible remuneration paid to an eligible employee by an eligible employer during the period beginning January 1, 2020, and ending March 15, 2020. Any period of seven or more consecutive days for which the employee was not remunerated is excluded from the calculation. However, the eligible employer may elect an alternative baseline period for calculating the average weekly eligible remuneration.

An additional elective alternative baseline remuneration computation for March 14 to June 5, 2021 (Qualifying Periods 14 to 16), is proposed to ensure that the baseline remuneration comparator remains appropriate. In particular, an eligible employer would be allowed to elect, for qualifying periods from March 14 to June 5, 2021, to use the period of March 1, 2019 to June 30, 2019, or July 1 to December 31, 2019 (the current alternative period), to calculate baseline remuneration.

The Canada Revenue Agency will administer this measure on the basis of draft legislative proposals released with today’s announcement.

The estimated cost for the wage subsidy from March 14 to June 5, 2021, is $13.9 billion in 2021-22 and the estimated cost for the rent subsidy and Lockdown Support from March 14 to June 5, 2021 is $2.1 billion in 2021-22. Costs may change depending on changing public health restrictions and economic activity.