The Canada Emergency Rent Subsidy (“CERS”) received Royal Assent last week and applications opened Monday through the CRA online system. This program is broader than the name implies – both renters and property owners may qualify for benefits to help offset their property-related costs including rent, mortgage interest, property taxes, insurance and even other costs. Businesses, Not For Profits and Charities could be eligible for support up to 65% of the property costs starting Sept 27th, with an additional 25% support available in situations where a Public Health Restriction reduced activity. Each applicant could receive up to $75,000 as support in each 4-week period. With such significant potential benefits, the related rules are complex and discussed in further detail below.

The CRA has released information and the application process through this link.

https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-rent-subsidy.html

Eligibility for the CERS program is open to individuals, taxable corporations and trusts, registered charities, certain non-taxable entities, as well as certain partnerships and specifically allowed organizations – however public institutions are specifically excluded. The applicant must also either have a CRA Business Number at Sept 27, 2020 or a CRA payroll account at March 15, 2020 (or someone making payroll remittances on their behalf). As well, it could be possible to establish a Business Number now to apply, or to make an election if a business assets have been acquired from a person that would have been eligible.

At this point, the CERS program rules have been released for 3 periods – Sept 27 to Oct 24 (claim process available now), Oct 25 to Nov 21 and Nov 22 to Dec 19 – but the program has been approved until June 21, 2021 so it is anticipated that further periods will be authorized. The deadline for applications is 180 days after the end of the particular period – meaning first period applications can be made until April 2021.

Qualifying property includes land and buildings in Canada used by the applicant in “ordinary activities”, but does not include property used as a personal residence. A wide variety of commercial and industrial buildings, retail space, storage compounds and even farm land could create a claim.

Calculating the potential CERS benefit is based on revenue reduction percentage of the applicant, and these criteria are modeled on the rules previously announced, and periodically updated, for the Canada Emergency Wage Subsidy. There are many fine details to the revenue calculations, but generally the month’s 2020 revenue for that respective application period would be compared to the revenue in the same month for 2019, or the average of the Jan/Feb 2020 revenue, and the decrease expressed as a percentage . Revenue from non-arm’s length sources – generally entities with common owners – is ignored for these calculations. As with the CEWS, it will be possible to use the more beneficial of the current period revenue decrease, or the immediately preceding period revenue decrease, in determining the amount of the CERS, and to choose between the cash or accrual method for recording revenue. There are also a variety of elections for applicants in regards to consolidated groups of entities, entities that participate in joint ventures arrangements, affiliated groups or applicants that received almost all of their revenue from non-arm’s length parties.

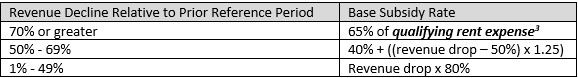

Once an eligible entity has determined their property qualifies and the amount of their revenue decline percentage, the calculation of the CERS base rate is as follows:

The rent top-up calculation is quite a bit easier – in each application period up to 25% can be added to the CERS base rate (if it was more than 0%) for the pro-rated period that the entity was subject to a “public health restriction”. Such a restriction is defined as a COVID related order from the government or authorized body that carries a fine or sanction that restricts some activities of the applicant that would affect at least 25% of their revenue that lasts at least one week. For example, a 14-day Saskatchewan government order to close the lounge that provides 40% of an entity’s revenue would create a rent top-up percentage of 12.5% – 25% * 14 days of the order / 28 days in the qualifying period.

Qualifying rent expense (“QRE”) is also more complex than the name suggests. In order to qualify as QRE, amounts must be paid in respect the 4-week application period (which CRA has indicated could be done up to 60 days after receipt of the CERS payment) in relation to a written agreement from before Oct 9, 2020 to arm’s length parties. What costs are eligible depends on the structure of the agreement, who owns the property and to whom the payments are being made.

Renters paying amounts to arm’s length parties would be eligible to claim base rent, contingent rent, certain amounts received by the landlord under the previous Canada Emergency Commercial Rent Assistance program, as well as additional amounts required to be paid under a net lease. These additional amounts are considered pretty broadly to include insurance, utilities, common area and other operating costs, property taxes and a general “other amounts payable” for services related to real property rental. An important criteria here is that the payments must be made to an arm’s length party – an operating business paying rent for a property owned in an entity owned by the same people (a fairly common structure) would NOT qualify under this definition, only amounts paid to third parties would be included. Specifically excluded are sales taxes, costs for damages, defaults, interest/penalties, guarantees or indemnities and special services or reconciliation adjustments.

Property owners – whether they use their property in non-rental activities in the same entity, or if they primarily rent the property to non-arm’s length parties – can also make a CERS claim but on a more limited list of costs. QRE in these situations consists of insurance and property taxes, as well as mortgage interest (not principal payments). However, the mortgage interest calculation has additional criteria to limit interest amount to the lesser of the interest calculations if they were calculated based on: the lowest principal balance on the property’s mortgage since it was acquired, or the cost amount of the property. Under these conditions, buildings that have been owned for a significant period, or that have greatly increased in value since acquisition and been used as security for borrowing, will not likely be able to claim their entire actual interest cost as QRE.

And in both cases, any rental revenue earned from arm’s length parties (including sub leases for renters) will directly reduce the applicant QRE amount.

To combat potential misuse of the CERS program, the rules also contain penalty provisions similar to the CEWS program. Attempts to manipulate the revenue calculations or qualifying rent expense amounts in order to qualify for CERS, or otherwise increase the amount of the CERS benefit applicable, will result in denial of any CERS benefit and a penalty of 25% of the amount that would have been available if the submission had been processed.

The CERS is another significant program with the potential to provide substantial benefit to qualifying applicants, but the rules are complex. Virtus Group has a team of professionals available to assist with assessing your situation and completing your applications – please contact your Virtus representative with any questions.