The post Federal government denies expenses on short-term rentals appeared first on Virtus Group.

]]>Authored by RSM Canada

Executive summary

Canada’s continued housing crisis has prompted the Federal government to introduce measures to disincentivize short-term rentals (STR) in order to free up units for long-term rentals. These proposed measures will deny expenses of short-term rentals which are non-compliant with local regulations. These new measures may result in increased rental income by the taxpayer, making the STR business model less appealing and viable.

Federal government denies expenses on short-term rentals

Canada’s continued housing crisis has prompted the Federal government to introduce measures to disincentivize short-term rentals in order to free up units for long-term rentals. The 2023 Federal Economic Statement (FES) stated that in just three major Canadian cities – Toronto, Montreal, and Vancouver – an estimated 18,900 homes were being used as STRs in 2020. This figure is likely an underestimation. For example, one study has estimated that more than half of Toronto’s STRs in 2023 were unregistered.

The Federal government has proposed new measures to deny expenses to STRs which are non-compliant with local regulations. These measures join other housing affordability measures including the Underused Housing Tax Act and First Home Savings Account.

What are STRs?

STR units are properties that are rented, partially or wholly, for a matter of days or weeks. Across Canada, an estimated 235,000 STRs were active in 2023. Legislation has already been passed at the provincial and municipal levels to curb the use of STRs by prohibiting these types of rentals in certain circumstances.

Current municipal and provincial rules

Various municipalities already have by-laws limiting the use of STRs. These include Toronto, Montreal, Ottawa and Calgary. British Columbia has passed similar legislation, which applies more stringently to areas with populations of 10,000 or more.

Most of these jurisdictions allow an operator to rent an STR only if it is their primary residence, thereby limiting the operator to just one STR property. There are also different limitations on the number of bedrooms that may be rented, the number of days for which the property can be rented, and the number of tenants per a rented room. The municipal and provincial rules also impose requirements for: licenses, permits or registration; insurance; and record-keeping and disclosure of rental details (such as the length of a rental and its price). Record and disclosure requirements are also imposed on STR rental platforms, such as Airbnb and VRBO.

Similar rules limiting STRs have been implemented in other jurisdictions including New York City (Local Law 18); Florence, Italy; and Byron Bay, Australia.

Proposed Federal tax legislation

In December 2023, the Department of Finance published proposed legislation which would deny income tax deductions for expenses incurred by certain STRs on or after Jan. 1, 2024.

These proposed rules apply to STRs which are non-compliant, meaning not permitted to operate due to applicable municipal or provincial regulation. The expenses denied are the expenses incurred during the year multiplied by the proportion of days of the STR’s operation during the year where it was non-compliant. For example, if the operator’s STR was non-compliant for one-quarter of the time the property was an STR, the CRA would deny one-quarter of the expenses that were claimed in respect of the use of that unit.

Impact on taxpayers

Generally, rental income is taxed on a net basis, due to the principle that taxes should apply to profits and not the cost of doing business. This makes expenses very attractive to operators of rental properties from a tax perspective, as their expenditures offset revenue and reduce their overall tax bill. However, under the new Federal legislation such offsetting is barred for non-compliant operators. Where an operator cannot deduct rental expenses, their taxable income will be higher, in some cases by tens of thousands of dollars, in turn resulting in higher taxes overall. Ideally, this would make the STR business model less appealing and viable to pursue.

An example of this is outlined in the FES: a fictional operator earns $120,000 of rental income annually from three STRs; to operate these STRs, they spend an estimated $120,000 per year. This operating cost includes mortgage interest, cable and internet bills, property insurance, condo fees, property taxes and capital cost allowance. Assuming this operator’s STRs were non-compliant year-round, the new legislation would bar them from deducting the entire operating expense of $120,000. The FES states this would mean an added cost of $33,100 in federal tax per year, which does not include the increased provincial tax burden.

Additionally, taxpayers that have long-term leases that legally become month-to-month leases should be aware of these changes as short-term rentals are defined as “a period of less than 90 days” in the proposed legislation and could result in the rental being classified as off-side.

Enforcement & efficacy

Enforcing the proposed legislation depends on identifying non-compliance under provincial and municipal regulation. Generally speaking, the provincial and municipal governments have similar STR compliance requirements. These include requirements that records of rental transactions be maintained by the STR operator or STR platform (or both), and that these be provided to the relevant government upon request. Some jurisdictions, such as Toronto and Calgary, have even produced registries of licensed STR units.

To enforce the regulations on STRs, some jurisdictions require a rental platform to remove an STR listing with an invalid registration. A variety of fines and penalties are in place for non-compliant operators. The City of Toronto has released data showing that it identified over 3,500 STR complaints between January 2021 and November 2023.

In spite of the various methods utilized by local governments to tackle the issue of non-compliant STRs, some commentators view the Federal legislation’s goals as easily thwarted. They note that crafty STR operators can simply attribute their non-compliant STR’s rental income to their primary residence, thereby skirting local rules. It is unclear how the Federal government could mitigate such a tactic.

The Federal legislation may still be ineffective because ensuring the expenses are properly denied requires obtaining information from local enforcement units. Where local enforcement is lacking, the Federal legislation becomes effectively inoperative. Despite its commitment to providing funding to assist municipalities in their STR enforcement, the Federal government lacks direct oversight over municipal and provincial enforcement operations.

Furthermore, the success of the expense denial measure in decreasing the number of STRs will depend on the strictness of the rules set by provinces and municipalities. As jurisdictions have not instituted identical rules, some are more tolerant of STRs than others. For example, unlike most jurisdictions, Montreal’s STR rules do not require the unit to be an operator’s primary residence. Due to a lack of uniformity, it is the strictness of each local government’s compliance scheme that will determine how much disincentive STR operators face.

Takeaway

In an effort to alleviate the housing crisis in Canada, the Federal government has effectively imposed a tax on non-compliant short-term rental units. This new measure increases the impact of pre-existing municipal and provincial regulations governing STRs. The Federal legislation’s effectiveness will be determined by how strict local regulations are and how diligently are enforced by local authorities. As a result of the new Federal rules, operators of STRs must familiarize themselves with municipal and provincial rules to avoid a substantial increase in their tax bill.

Let’s Talk!

Call us at 1-888-258-7677 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Clara Pham, Farryn Cohn, Jim Niazi and originally appeared on 2024-01-26 RSM Canada, and is available online at https://rsmcanada.com/insights/services/business-tax-insights/federal-government-denies-expenses-short-term-rentals.html.

The information contained herein is general in nature and based on authorities that are subject to change. RSM Canada guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM Canada assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

Virtus Group is a proud member of the RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how the Virtus Group can assist you, please call us at 1-888-258-7677. |

The post Federal government denies expenses on short-term rentals appeared first on Virtus Group.

]]>The post Paying attention to risks as you shift your business to the cloud appeared first on Virtus Group.

]]>Authored by RSM Canada

Despite the obvious advantages of a digital transformation—like creating an efficient, agile and easily scalable organization—many transformations fail.

Especially when it comes to risk management, “measure twice, cut once” is sound advice. Stopping to assess your desired outcomes and mapping a route to get there can help. Whether your organization has undergone a cloud migration that has missed the mark or has not begun that move at all, anticipating the common pitfalls can help you better plan and execute this shift. Here are some of the cases we see most often.

Threat blindness

Middle market companies may feel relatively insulated from cyber threats, but the numbers tell a different story. In the 2023 RSM US Middle Market Business Index Cybersecurity Special Report, 20% of middle market executives claimed their company experienced a data breach within the last year. Cybercriminals may target these organizations looking for systems that are easily exploited partly because they tend to have a less sophisticated cyber security regime.

20% of middle market executives claimed their company experienced a data breach within the last year

Misplaced trust

Cloud providers and SaaS solutions suppliers emphasize their security features and take them seriously. But the security they are referencing is within their platform, not for your data. Many organizations misunderstand this distinction, leaving their data exposed.

The other commonly discounted risk is the one coming from inside your organization. Whether knowingly or because of increasingly ingenious phishing and deep fake attempts, your employees pose a real threat. In fact, 35% of cyberattacks come from inside organizations. And 64% of those attacks are successful compared with the success rate of 51% for external attacks.

Misconfigured security

While a do-it-yourself approach can work for some projects, a cloud migration isn’t always one of them. Security tools can be misconfigured and vulnerabilities can go unchecked out of inexperience or because your IT team is stretched too thin. Given the complexity of cloud architecture and the number of cloud environments that need to be managed, you may need an advisor to ensure your risks are mitigated.

35% of cyberattacks come from inside organizations. And 64% of those attacks are successful compared with the success rate of 51% for external attacks.

Tackling risk based on your installation method

Technology is an essential element of a secure architecture, but the people planning, executing and maintaining your cloud security are just as important. There are three central approaches to moving your business to the cloud, all of which are dependent on the skills, knowledge and experience of your team.

Self-serve installation

As noted earlier, this can be a tall order. Your team will need to have the time and resources to find vendors, plan the migration and then manage security and maintenance. This may seem like the least expensive option at first glance, but the high cost of talent and the complexity of a cloud migration may be more than your team can reasonably handle. Many organizations that embark on a self-serve migration eventually end up calling a third party to complete the task.

Working with a vendor

Technology vendors are skilled at guiding their customers through the installation and usage phases of software implementation, and cloud services providers can assist in your migration. But while they have expertise in their products, they may not be as skilled at customizing the plan and framework for your digital migration. Compliance requirements, for example, might not be part of their process. These blind spots can limit the functionality and flexibility of your framework.

Teaming up with an advisor

Consultants skilled in the various phases of a digital transformation, from cloud assessments through software development, can help guide your team from planning through installation, management and security. After working through multiple cloud migrations, they will have a greater knowledge of what does and doesn’t work as well as tips for success.

Not all consultants are equal, and you should ask plenty of questions before engaging an advisor. Some of these include:

Do you have a standard approach to data migrations or is it customizable for our needs?

Does your team have experience in our industry?

What kind of qualifications does your team have?

Let’s Talk!

Call us at 1-855-206-5697 or fill out the form below and we’ll contact you to discuss your specific situation.

Source: RSM Canada

Used with permission as a member of RSM Canada Alliance

https://rsmcanada.com/insights/services/risk-fraud-cybersecurity/paying-attention-to-risks-as-you-shift-your-business-to-the-cloud.html

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

Virtus Group is a proud member of the RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how the Virtus Group can assist you, please call us at 855-206-5697. |

The post Paying attention to risks as you shift your business to the cloud appeared first on Virtus Group.

]]>The post Owning Rental Properties in Canada: Corporation vs. Personal Ownership and Tax Implications appeared first on Virtus Group.

]]>This choice can significantly impact your tax liabilities, asset protection, long-term financial goals and often depends on various factors including your own financial situation. In this article, we’ll explore the Canadian tax implications of owning rental properties within a corporation compared to personal ownership.

Personal Ownership of Rental Properties

- Rental Income Taxation: When you own rental properties personally, the rental income is added to your personal income each year and reported on a rental schedule of your personal tax return. This income is taxed at your marginal tax rate, which could potentially result in a higher tax burden when it is added to your other sources of income (employment income, pension income and investment income.)

- Deductions and Expenses: You can deduct eligible expenses related to the rental property, such as mortgage interest, property taxes, maintenance costs, insurance, property management fees, utilities and more, that are paid by you, to reduce your taxable rental income. However, the deductions are limited by specific rules and subject to scrutiny by the Canada Revenue Agency.

- Capital Cost Allowance (CCA): You can claim CCA, also known as depreciation, on the cost of the building and certain eligible capital expenses. This allows you to deduct a portion of the property’s cost each year to account for wear and tear.

- Capital Gains Tax: When you sell the rental property, it is treated as a disposition on your personal tax return and any increase in its value from when it was purchased up to when it was sold (capital gain) is subject to capital gains tax.

Generally, only 50% of the capital gain is taxable. You may need to recapture a portion of the CCA you previously claimed as income. The recaptured CCA is included in your income in the year of sale. The recapture is generally equal to the lesser of the total CCA claimed or the capital gain on the property.

Owning a Rental Property within a Company

- Rental Income and Expenses: When a corporation owns a rental property, it will generate rental income. The corporation can deduct eligible expenses, such as property maintenance, mortgage interest, property taxes, utilities, and property management fees from its rental income to determine its taxable rental income.

- Reduced Tax Rates: There is the potential for tax rate savings if the properties are held within a company. If the Company has 5 or more full-time employees, the income will change from inactive income to active business income and would have a lower corporate tax rate than normal personal rates.

However, most companies who own rental properties are considered to have inactive income which means it is taxed at a higher federal tax rate and not the small business rate. The federal small business tax rate is generally lower than personal income tax rates, which can often provide potential tax savings.

This is not always the case, so it is important to talk with your accountant regarding potential tax savings. - Opportunities for tax-deferred growth: As noted above, the rental income is taxed at the corporate level, which may allow for more capital to reinvest in the property or other investments.

- Incorporating rental properties can offer asset protection: If you face legal issues or the property generates liabilities, your personal assets are less exposed because the corporation is a separate legal entity.

- Losses: Rental property losses in a corporation may not provide the same immediate personal tax benefits as they would if the property were owned personally. Corporate losses can be carried forward to offset future rental income or carried back for up to three years to offset past rental income and recover income taxes that have been paid, but they cannot generally be used to reduce other forms of income for the shareholders.

- Passive Income Rules: In Canada, certain rules aim to prevent the accumulation of passive investment income within a corporation. These rules can affect the tax advantages of corporate ownership for rental properties. If a corporation earns significant passive income, it may be subject to higher corporate tax rates. Rental income is generally considered passive income, so this could affect your tax liability.

Article Wrap Up

The decision to own rental properties within a corporation or personally is multifaceted and depends on your unique financial situation and objectives. While owning rental properties within a corporation can offer tax advantages, it also comes with added complexity and requires diligent tax planning. Personal ownership, on the other hand, may result in a higher tax burden but is often simpler to manage.

In either case, it’s crucial to consult with tax professionals who can help you navigate the complexities of Canadian tax laws and make informed decisions that align with your financial goals. Balancing the potential tax benefits with administrative responsibilities will be key in determining the best ownership structure for your rental properties.

The post Owning Rental Properties in Canada: Corporation vs. Personal Ownership and Tax Implications appeared first on Virtus Group.

]]>The post Automate and elevate: Driving business value to new heights appeared first on Virtus Group.

]]>Authored by RSM Canada

In today’s competitive and fast-paced business environment, automation is not just a buzzword—it’s a necessity.

Business and professional services (BPS) firms face numerous challenges, including improving project profitability and margins, adapting to shifting customer expectations and reducing administrative tasks. BPS business models rely on individuals with specialized skills, expertise, and knowledge but often must optimize internal resources while working to acquire and retain talent.

Each of these hurdles can be addressed with automation, which can help firms improve operational efficiency, enhance service, and drive value for customers and employees.

Start with a holistic approach

Automation is often approached as a solution for a specific business problem. Business owners may adopt an automation platform to optimize one inefficient business function, such as a customer relationship management (CRM) system to improve client management or an accounting system to modernize financials. While these systems can lead to small improvements within a department, operating multiple siloed systems often increases inefficiencies and redundancies across the organization.

“When we talk about automation, we want to reduce or eliminate the disparate and unintegrated systems. Embracing automation can help you compete in today’s market,” says Karen Wiltgen, principal and national business and professional services consulting leader at RSM US LLP.

Rather than address inefficiencies symptomatically, businesses should take a holistic approach and strategically automate each business function so that all functions work together.

“A key focus should be developing a digital strategy that provides a three-to-five-year road map that outlines and creates a clear path aligning to your business strategic goals. To achieve the greatest value, determine the benchmarks to hit and the tactics that will lead you to success,” Wiltgen says.

To build a fully effective automation solution, it’s critical to evaluate the root cause of inefficiencies and address how each function of the business individually and in relation to others.

“When we talk about automation, we want to reduce or eliminate the disparate and unintegrated systems. Embracing automation can help you compete in today’s market.”

Karen Wiltgen, principal and national business and professional services consulting leader, RSM US LLP

Focus on value drivers

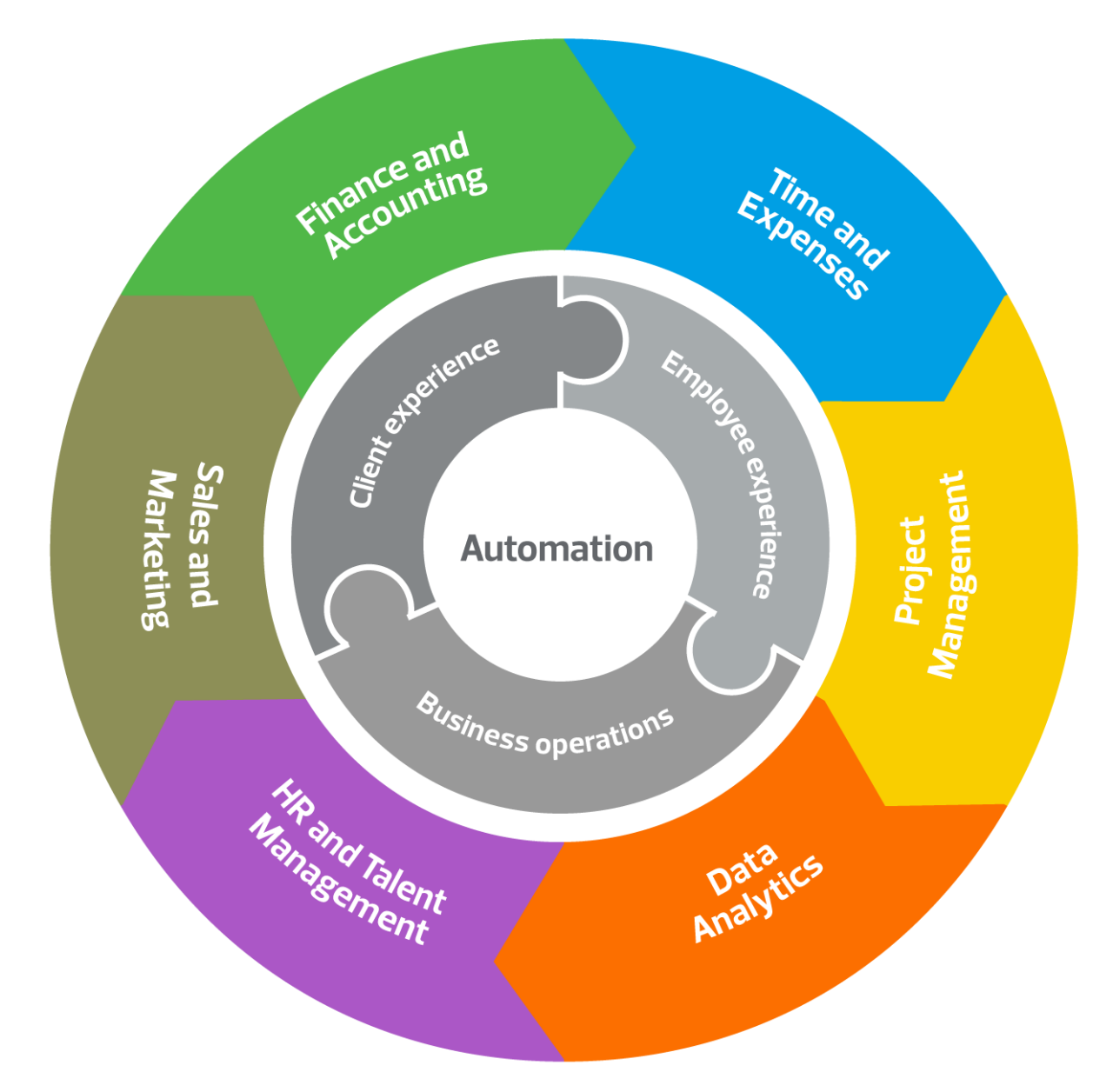

A digital solution that maximizes your overall business value will include significant transformations of the areas of your organization that drive the most value. These typically include your business operations, client experience and employee experience.

Automation of your business operations will primarily focus on improvements to your back office. An effective digital solution will go beyond automating your finance processes and updating your demand generation process; it should provide proactive client management, improve project margins, reduce the risk for over-budget and overdue projects, and expand your ability to secure strategic clients.

To deliver a seamless client experience across all channels of engagement, implement automation that reduces barriers and issues a client might encounter while engaging with the business. This strategy can save time and effort and boost client retention. Optimizing project operations can help you increase efficiency and manage resources, leading to improved business performance and profitability. This can improve time to value, increase the odds of a successful engagement and boost overall client satisfaction.

Automating to enable collaboration, increase project visibility across the business, and improve resource management enhances the employee experience, increasing talent retention, co-ordination and productivity.

Automate solutions across key business functions

A holistic automation transformation can improve the following critical business functions:

- Accounting. Reduce operational inefficiencies and administrative costs while improving the talent experience. Streamlining your billing and invoicing processes will reduce the need for manual data entry and ensure accurate and timely billing.

- Time and expense tracking. Enhance the employee experience and remove operational redundancies. An automated time and expense tracking system also reduces your risk of errors and increases project profitability.

- Project management. Improve the customer experience and streamline operations with a system that aids your talent around project management activities. Manage your projects and workflows more efficiently, improving project timelines, resource allocation and utilization, and overall project profitability.

- Data analytics and reporting. Enhance operational efficiency and reduce the need for manual data entry and analysis. Dashboards and reports can provide insights into client profitability, project profitability, and overall business performance more accurately and quickly.

- Sales and marketing. Improve business operations and the employee experience by saving time and resources. Automate lead generation, email campaigns, and social media posting to reach and engage target audiences effectively.

- Human resources and talent management. Optimize the employee experience and simplify administrative personnel tasks, including payroll. Achieve increased productivity and profitability by automating processes that enable you to hire and retain top talent.

Addressing these operational and process challenges through increased automation is critical for services organizations striving to maintain profitability, competitiveness and customer/client satisfaction. Organizations that look to automation to effectively face these challenges head-on are better positioned for long-term success.

Let’s Talk!

Call us at 1-855-206-5697 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Karen Wiltgen and originally appeared on Jun 18, 2023 RSM Canada, and is available online at https://rsmcanada.com/insights/industries/business-services/automate-and-elevate-driving-business-value-to-new-heights.html.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

Virtus Group is a proud member of the RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how the Virtus Group can assist you, please call us at 855-206-5697. |

The post Automate and elevate: Driving business value to new heights appeared first on Virtus Group.

]]>The post 5 elements of a successful business exit plan appeared first on Virtus Group.

]]>Regardless of where you are in your career, having a business exit strategy is imperative. Our advisors put together a list of 5 critical things to consider when closing or selling your company.

A business exit is a matter of when, not if

A business exit is inevitable. 100% of business owners will leave their company, some sooner than later. Since an exit is inevitable, you’ll want to keep the following in mind.

- 69% plan to exit in the next 10 years

- 68% haven’t discussed their exit with their spouse or family

- 85% have no one to replace their skills or responsibilities

- 92% haven’t put their plans in writing

- 10% have no exit plan at all

1. Identify Your Objectives

Prepare a written Business Exit Plan based on your unique goals. Even if you begin only with a list of bullet points, take time to do this important step on your own before consulting with advisors and other stakeholders. If you need help with this, contact one of our Advisors.

2. Build a Team to Refine and Implement Your Business Exit Plan

No single professional has the all answers, skills and talents needed to develop and execute a comprehensive Business Exit Plan. Make sure at least one team member understands the exit planning process and has the time and resources to keep things on the right path. An experienced Exit Planning Advisor can streamline the process and make your transition more successful.

3. Understand Your Cash Flow and Quantified Business Value

You’ll ideally want to have a positive cash flow from your business to prove to an external third-party purchaser that your business has value. If you’re selling internally, the future cash flow of the business will fund your payoff.

If you’re selling to a third-party buyer, they’ll know how much they’re willing to pay, so you need to know what your business is worth so your buyer doesn’t have the advantage.

4. Build a Strong Management Team

It’s easier to sell a business with solid management. Outside buyers in particular will be more interested if there is a strong team who will remain and continue to run the business after it’s sold. If all of your corporate wisdom is in your brain, it will leave when you do—and lessen the value of your business.

5. Allow Time to Execute Your Business Exit Strategy

Planning and implementing a proper Business Exit Plan takes time. In fact, it can take years to build a strong management team or to build up enough cash flow to support the value you need.

A business exit doesn’t have to be complicated. However, it does require some forethought and planning to ensure the transition will be easier—and more profitable.

Questions? Get in touch with our business advisory experts.

The post 5 elements of a successful business exit plan appeared first on Virtus Group.

]]>The post 6 things to consider when deciding how to pay yourself appeared first on Virtus Group.

]]>As a business owner, you may have wondered about the differences between paying yourself via dividends versus drawing a salary, and how this may affect your tax burden.

Assuming your business is incorporated, you have the flexibility to pay yourself via dividends, drawing a salary, or a combination of both. But the question becomes: which is better for your business (and taxation purposes)?

Dividends, salaries or a mix of both?

The optimal solution is dependent upon your business and its structured. When considering which option(s) may be best for your business, it is important to understand the differences between salaries and dividends and how each are taxed.

Salaries

- Salaries are deducted from company income lowering corporate income taxes paid

- Salaries are taxed at a higher tax rate in the hands of the individual receiving the salary (when compared to dividends)

- Salaries require payroll remittances to be made by the employer (additional administrative burden)

- When paying salaries, employers are required to match CPP remittances therefore there is an additional cost to the company

- Salaries contribute to creating RRSP room for retirement savings

- Requires a T4 tax filing annually

Dividends

- Dividends are paid by the company using after-tax dollars (no tax deduction for the company)

- Dividends are taxed at a lower tax rate in the hands of the individual (when compared to salaries)

- As there is no remittance requirement with dividends they are considered to offer more flexibility (no structured payroll schedule required)

- Dividends do not help the individual tax payer generate RRSP room

- Requires a T5 tax filing each year a dividend is declared/paid

Salary vs. dividend considerations

Now here are a few things to consider when deciding which compensation structure works best for you and your business:

- Whether paying salaries or dividends to yourself as a shareholder, the total taxes paid when looking at the individual and company, will be the same.

- It will depend on your individual situation.

- Salaries are more structured, offer more stability in managing your personal tax bill due to the monthly tax remittances and also assist with retirement planning due to their ability to increase RRSP contribution room.

- Banks generally view salaries more favorably due to their structured nature and this should be taken into consideration if you will be looking for financing or a mortgage.

- You are not required to pick one or the other. You can choose to do a mix of both if that’s the best fit for you.

- If you choose to compensate using dividends one year, you can choose to opt to using salaries at some point in the future (not locked in).

Conclusion

When deciding between salaries and dividends, there is no “one size fits all” solution. All available options should be explored with your advisor. Should you have any questions regarding compensation structure, please contact your Virtus advisor or fill in the form below.

The post 6 things to consider when deciding how to pay yourself appeared first on Virtus Group.

]]>The post 6 key budgeting tips for a successful business appeared first on Virtus Group.

]]>The difference between a company that succeeds and one that fails is often cash management. Businesses typically take on debt and it is important that you have cash flow projections to provide comfort that the debt can be repaid in a timely fashion.

Having too little cash flow means you may be unable to deal with unforeseen circumstances, having to pass on profitable ventures, increasing loans to overcome liquidity issues, and creating a reduction to the value of your business

Here are some key business budgeting and cash flow tips to think about when operating your business.

1. Cash flow is different than profit

- It is movement of money in and out of your business

- Your business can still generate profit and have negative cash flows

- Your business can also generate a loss and still have positive cash flows

2. Utilize tools to manage your cash flows

- Prepare, analyze, and manage budgets

- Ensure you know what your businesses cash requirements are

- Consider if your business has seasonal fluctuations – as this will affect cash flow

- Think ahead to any large capital expenditures that may be required that will require cash

- Have a contingency plan in place

- Consider financing options if you need cash or investing options if you have a cash surplus

3. Cash spending, collection & payment

- Manage inventories to ensure turnover is appropriate

- Progress invoice where necessary

- Ensure invoices are prepared promptly and credit terms/policies are in place

- Collect down payments when necessary

- Negotiate credit terms on accounts payable

- Request trade and volume discounts where necessary

4. Ensure you budget for taxes

- Because you can generate a profit when you have negative cashflows, you may owe corporate taxes even when you have no cash

- Ensure you are keeping “cash on hand” to pay your tax bill

5. Estimate how much cash is needed on hand

- A good estimate is 3-6 months of overhead activity

- Project any large future expenses

- Consider your debt and required loan payments

6. Cash flow budgeting/projections should be updated

Considerations include:

- Does current financing remain viable?

- Reconsider variable costs (can you cut spending in certain areas)

- Consider alternative or new revenue streams that fit with the business

- Convert fixed costs to variable when possible

- Are shareholders drawing more cash than necessary

Conclusion

It is said you need to spend money to make money, however, it is important that you have that cash on hand to spend. Hopefully by applying some of the above concepts, it can help your business to prosper and manage it’s cashflows and budgeting.

Questions? Get in touch.

The post 6 key budgeting tips for a successful business appeared first on Virtus Group.

]]>The post 7 ways to develop your business strategy appeared first on Virtus Group.

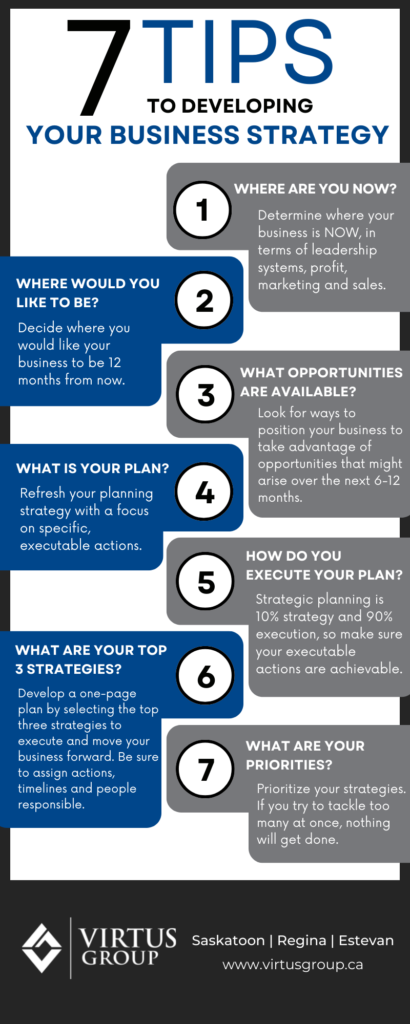

]]>Here are seven tips for boosting your business strategy to position you for growth.

Click here to download a PDF version of the infographic above.

7 tips for planning your best business strategy

- Determine where your business is NOW, in terms of leadership systems, profit, marketing and sales.

- Decide where you would like your business to be 12 months from now.

- Look for ways to position your business to take advantage of opportunities that might arise over the next 6-12 months.

- Refresh your planning strategy with a focus on specific, executable actions.

- Strategic planning is 10% strategy and 90% execution, so make sure your executable actions are achievable.

- Develop a one-page plan by selecting the top three strategies to execute and move your business forward. Be sure to assign actions, timelines and people responsible.

- Prioritize your strategies. If you try to tackle too many at once, nothing will get done.

How Virtus group can help

With our expertise at Virtus Group, we have extensive knowledge in developing business strategies for small and medium sized businesses in Saskatchewan across a number of industries, including agriculture, financial, energy, manufacturing, not-for-profit and professional services.

We’ll help you develop a clear one-page plan, then meet with you on a monthly or quarterly basis. Our supported business strategy will help your team focus on key areas you’ve identified to move your business forward.

We’ll also help you define your Sustainable Competitive Advantage (SCA). This is a statement that describes the type of business you will compete in and win in your market, and it outlines what makes your business unique among your competitors.

Your SCA will drive your marketing strategy, which will then drive your operational strategy.

Once you focus on executing your overall strategy, you’ll be able to really advance your business over the next few months.

Questions? Get in touch.

We’d be happy to answer any questions you may have. Please fill in the form below to get started.

The post 7 ways to develop your business strategy appeared first on Virtus Group.

]]>The post 5 key business issues restaurants are facing appeared first on Virtus Group.

]]>Authored by RSM Canada

Evolving consumer preferences and a tight labour market are among the challenges 2022 is serving up.

Restaurant operators have been on a roller coaster since the start of the pandemic. Faced with restrictions, shutdowns, reopenings and then further restrictions, the industry now appears to be adjusting to a new normal. Some restaurants failed, some flourished and most limped along with the help of government programs. Nonetheless, the pain the industry has felt these past two years has created opportunity for survivors as we emerge into a new operating environment. To capitalize on those opportunities, operators have much to consider.

Managing agility

The pandemic tested the flexibility and agility of consumers and operators. Evolving pre-pandemic consumer preferences were disrupted and accelerated. Operators with robust off-premises platforms grew out of necessity and many flourished, while others adapted operations to keep units open.

As we continue to emerge, many of the buying behaviours developed over the past several months will likely continue. Many on-premises diners forced to off-premises platforms during the pandemic grew accustomed to the convenience of mobile ordering and payment, drive-throughs, and curbside pickup, and operators who previously resisted off-premises concepts learned they could produce a quality off-premises product.

Quick-serve concepts will need to adapt operating models and physical footprints to accommodate more throughput during peak hours. Traditional on-premises operators will need to enhance their on-premises experience to capitalize on pent-up demand for social dining, while trying to maintain the off-premises business they grew during the height of the pandemic. Temptation to revert to pre-pandemic models should be resisted, as operating flexibility and agility will be the keys to success in this new environment.

Leveraging technology

The importance of technology was made abundantly clear during the height of the pandemic. Businesses with established digital platforms were able to operate at a high level and continue to grow. Others began to build out platforms and introduce technology in key areas of their operations. As operators adapt operating models to meet changing consumer preferences, technology infrastructure should also be assessed and new technologies introduced where appropriate. Data analytics will become increasingly important to evaluate operations and better understand customer preferences and buying behaviours. As technology is added, cybersecurity should also be assessed and enhanced for operating units, corporate offices and remote employees.

Addressing labour challenges

Labour will be a significant challenge for restaurant operators in 2022 and beyond. Costs will continue to rise, but labour shortages will likely have a greater impact on operations and may limit growth. Successful businesses will leverage technology and data across their operations. Understanding traffic patterns and buying behaviours will allow operators to deploy resources more effectively. The use of mobile apps for payment will become the norm in quick-service restaurants and fast casual, and hand-held technology for servers in on-premises establishments will facilitate effective service with fewer employees. Operators will also need to employ creative recruiting and retention strategies to attract and retain the staff they have, as labour shortages in other industries will continue to draw people away from them.

Considering inflation

Inflation is already having an impact on the restaurant industry. As prime costs continue to rise, operators will have no choice but to raise prices and adapt menus. While pent-up demand will provide some price elasticity, the cost of rent, fuel and other consumer necessities will diminish disposable income and affect buying behaviours. Quick-serve concepts with low to moderate price points typically benefit when consumers need to stretch their disposable income. On-premises concepts will need to re-engineer menus to provide greater value and enhance the overall dining experience.

Investing for growth

Despite the significant challenges of the past 24 months, there is room for optimism. Demand for food away from home remains high, and changing consumer preferences and restaurant closures have created opportunity for growth across the industry. Expect investment in the industry to continue to ramp up in 2022 as on-trend, tech-enabled concepts expand their operating footprints and distressed brands look for financial partners to help them survive and evolve their operating models to accommodate shifts in consumer behaviour. Savvy investors will focus on young, on-trend brands with room for significant growth and also will bargain hunt for well-known, established brands needing investment capital to adapt to the new environment.

Let’s Talk!

Call us at 1-855-206-5697 or fill out the form below and we’ll contact you to discuss your specific situation.

Source: RSM Canada

Used with permission as a member of RSM Canada Alliance

https://rsmcanada.com/insights/industries/restaurant/5-key-business-issues-restaurants-are-facing.html

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

Virtus Group is a proud member of the RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how the Virtus Group can assist you, please call us at 855-206-5697. |

The post 5 key business issues restaurants are facing appeared first on Virtus Group.

]]>The post New Compilations Standard appeared first on Virtus Group.

]]>Who does this impact?

If you have previously had Virtus Group issue a “Notice to Reader” report on a set of financial statements, a new standard issued by CPA Canada will affect our engagement with your company or organization and the appearance of our reporting. The new standard is called CSRS (Canadian Standards on Related Services) 4200 – Compilation Engagements and is effective for compiled information for periods ending on or after December 14, 2021.

Why is it changing?

The objective of the standard is to not only help practitioners in performing compilation engagements but also to more clearly communicate to users of financial information the responsibilities of management and the practitioner and the nature and scope of the engagement.

It will be important for us to understand how the financial information being compiled is being used, in particular, if it is used by third parties such as a bank or shareholders. If there is no third-party use, there may be circumstances where no compilation report is needed on the information, such as when the engagement is limited to bookkeeping or if the financial information is used only for a tax filing.

What is changing?

If a report is needed on the information, the report will look different than the old report. It will be called a “Compilation Engagement Report” and not a “Notice to Reader”. It will be longer and have more information, including the responsibilities of both management and the practitioner and will specify that an audit or review engagement was not performed. It will refer to “financial information” rather than “financial statements”. The financial information will no longer say “Unaudited – See Notice to Reader” on it. Finally, there will be a note to the financial information that specifies the basis of accounting. We can assist in defining the basis of accounting for the note, but management must concur that the basis is appropriate.

If you would like more information on whether or how this standard affects our engagement with your company or organization, please reach out to a member of our team for further details.

Partner

If you have questions about these changes. Please fill in the form below and someone will get in touch with you.

Questions? Get in touch.

The post New Compilations Standard appeared first on Virtus Group.

]]>